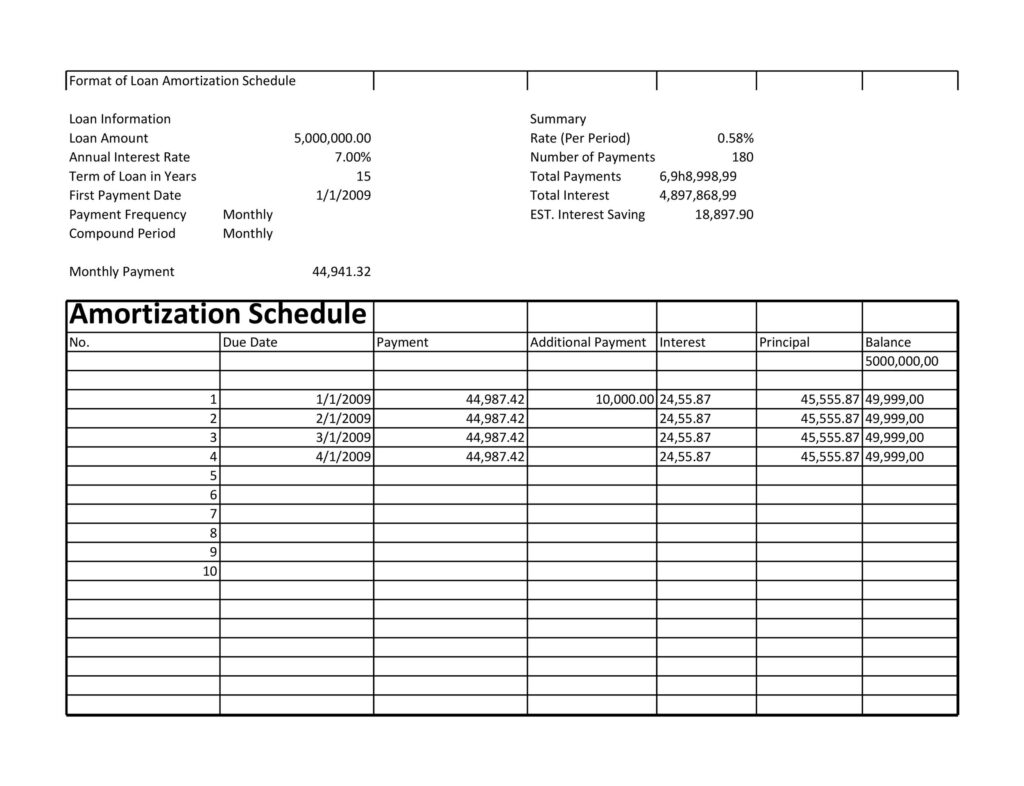

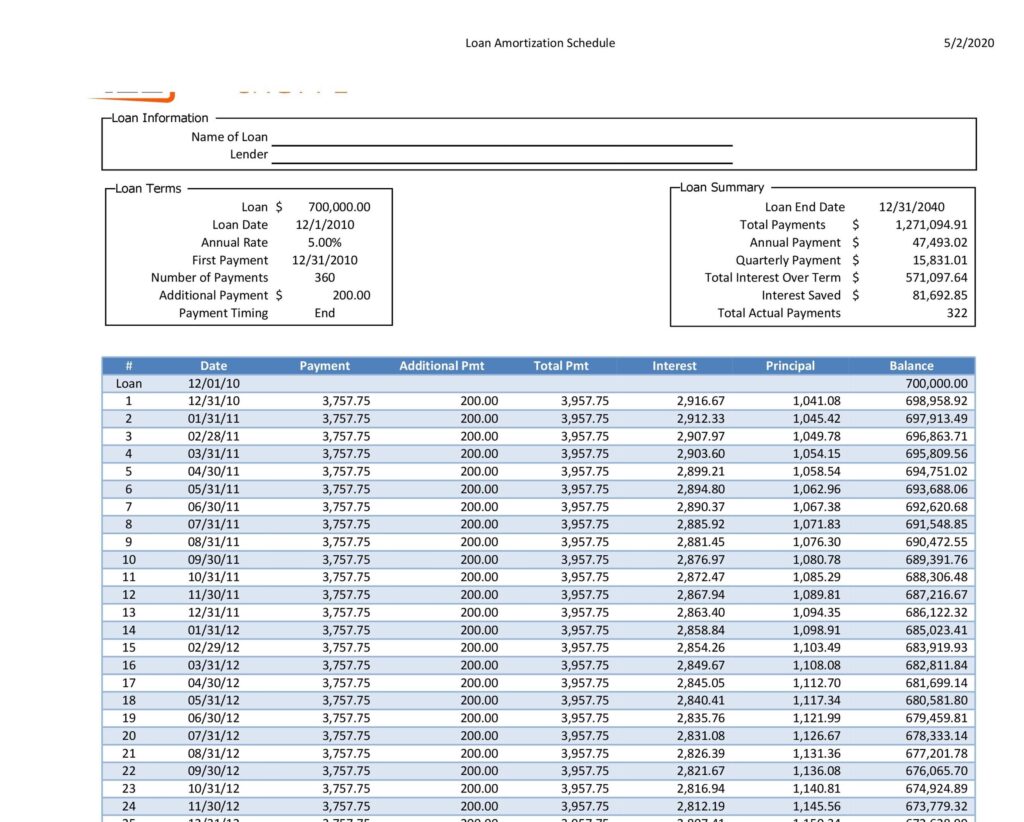

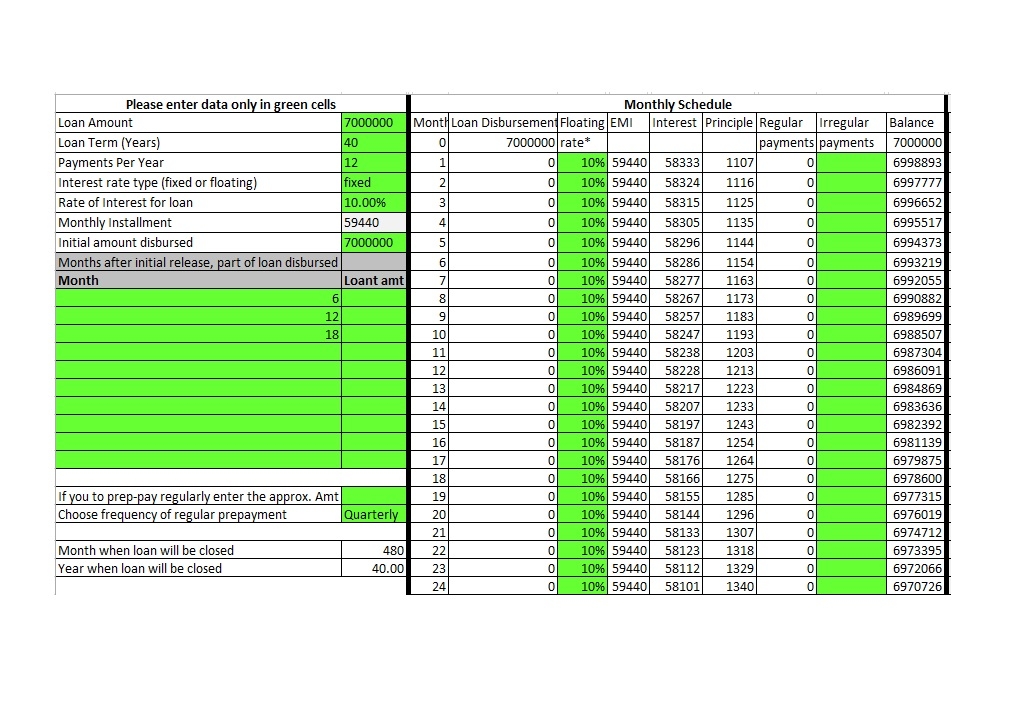

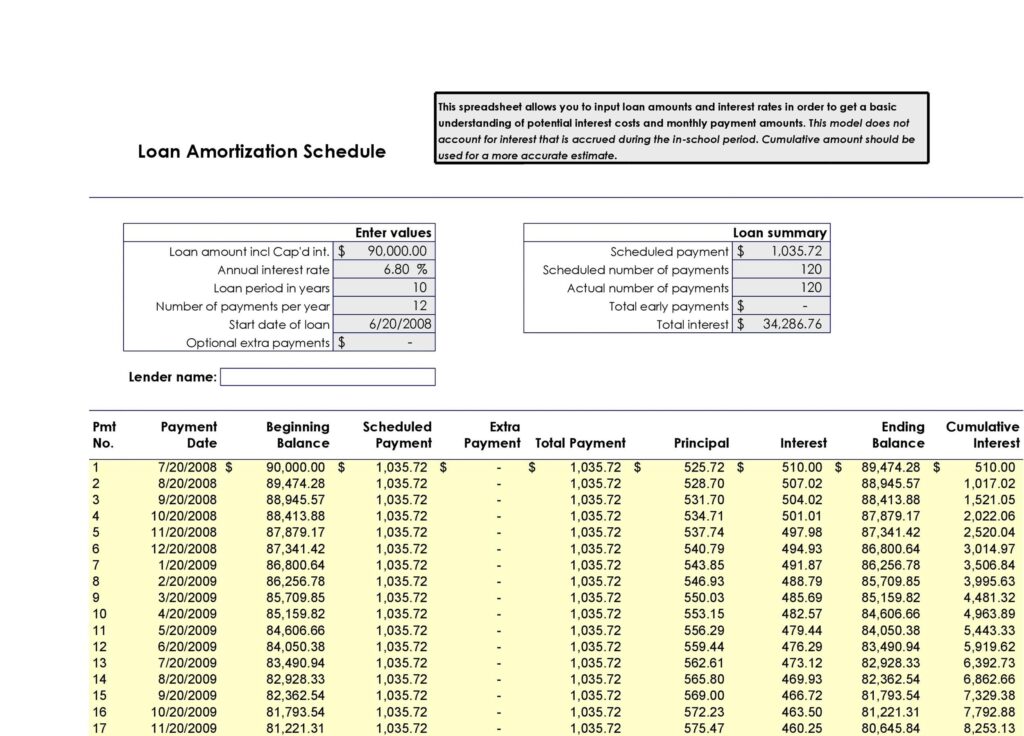

An additional factor to consider is usually downloading a Loan Amortization Schedule Excel. They will possess an almost all set Template to will certainly only have got to fill-in many cells as well as your Amortization amount and Payment Schedule can come out.

One more importance of getting a Loan is definitely to determine your credit status. This really can be necessary therefore that you can account your procedures well. A good credit status means acquiring reduce interest prices, higher Loan quantity and higher trust from financial organizations. Therefore, monitoring your Payments is usually necessary intended for higher credit score.

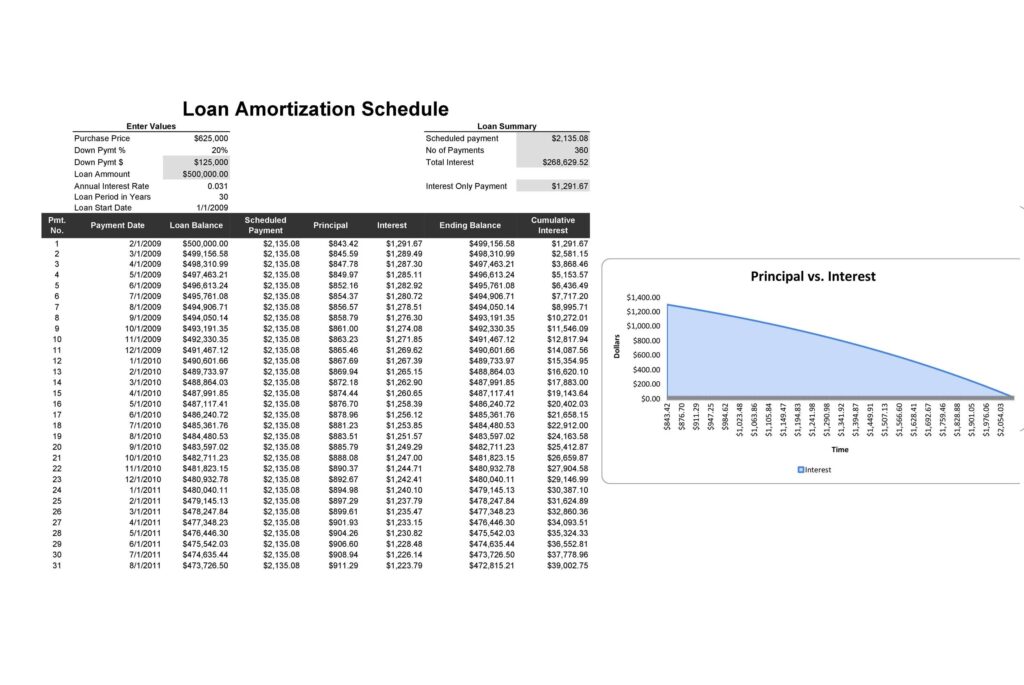

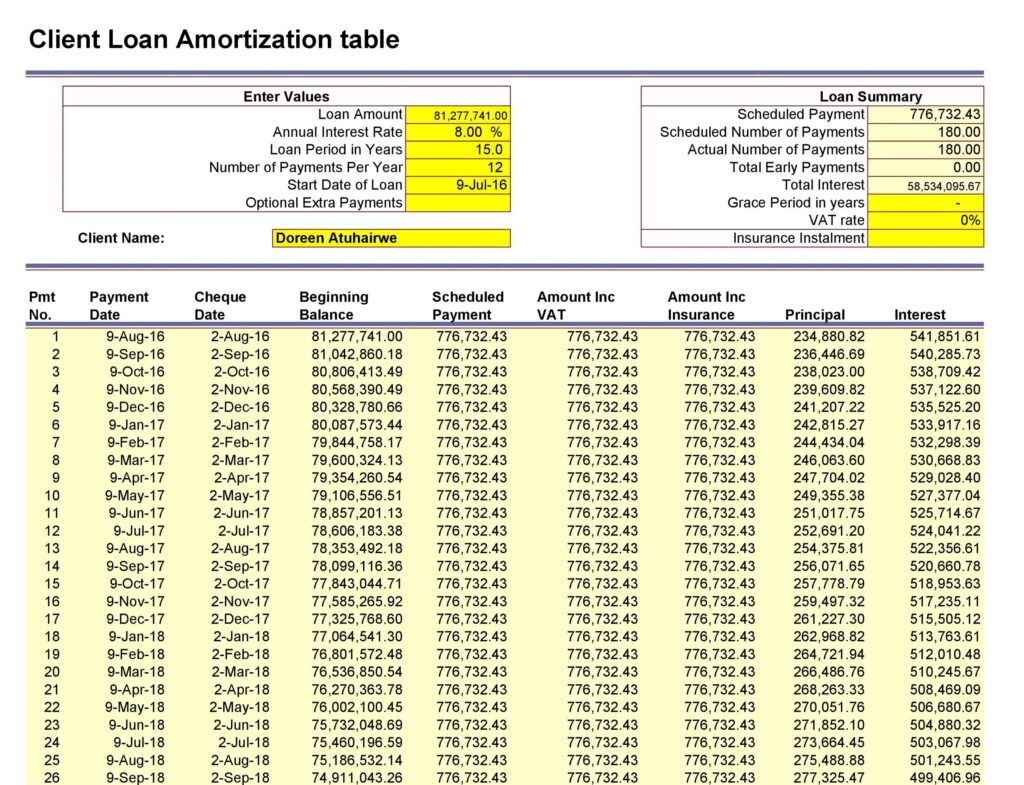

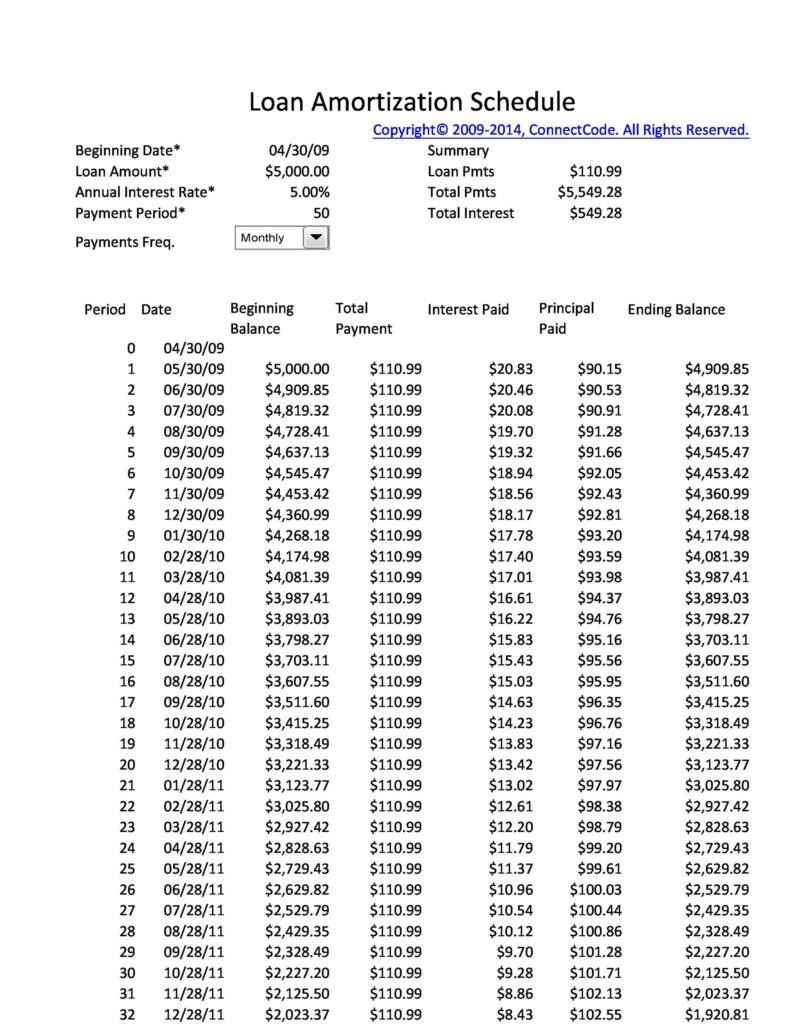

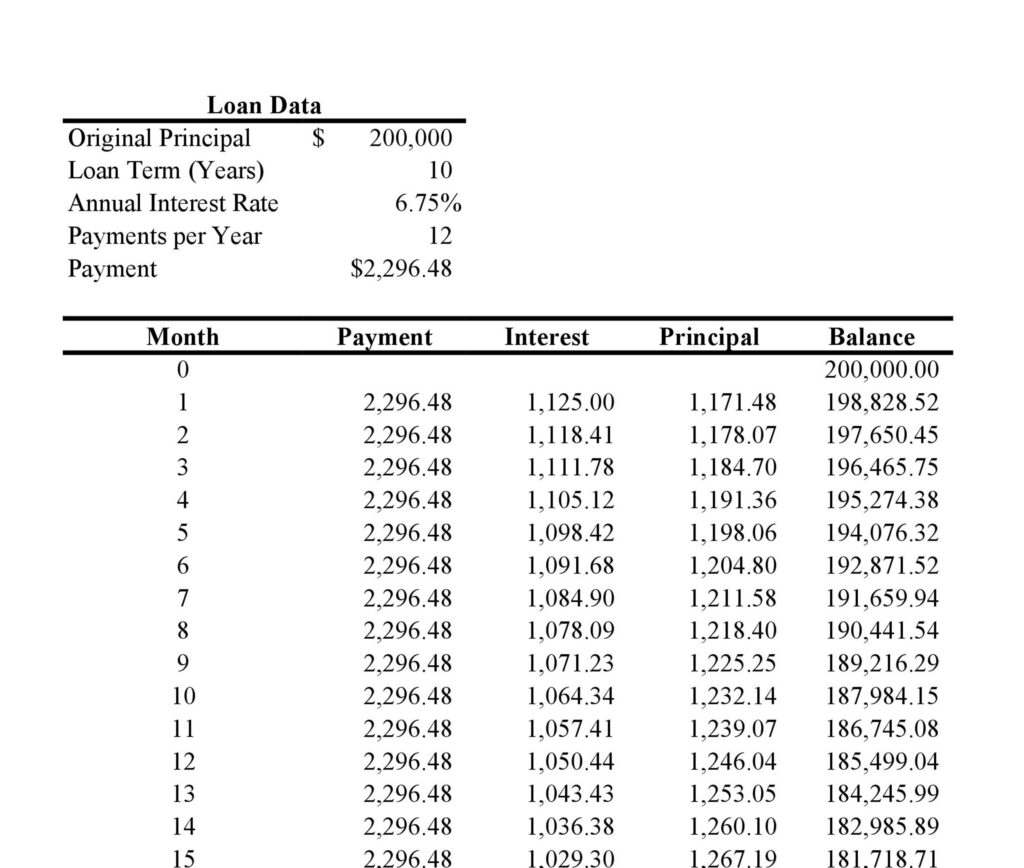

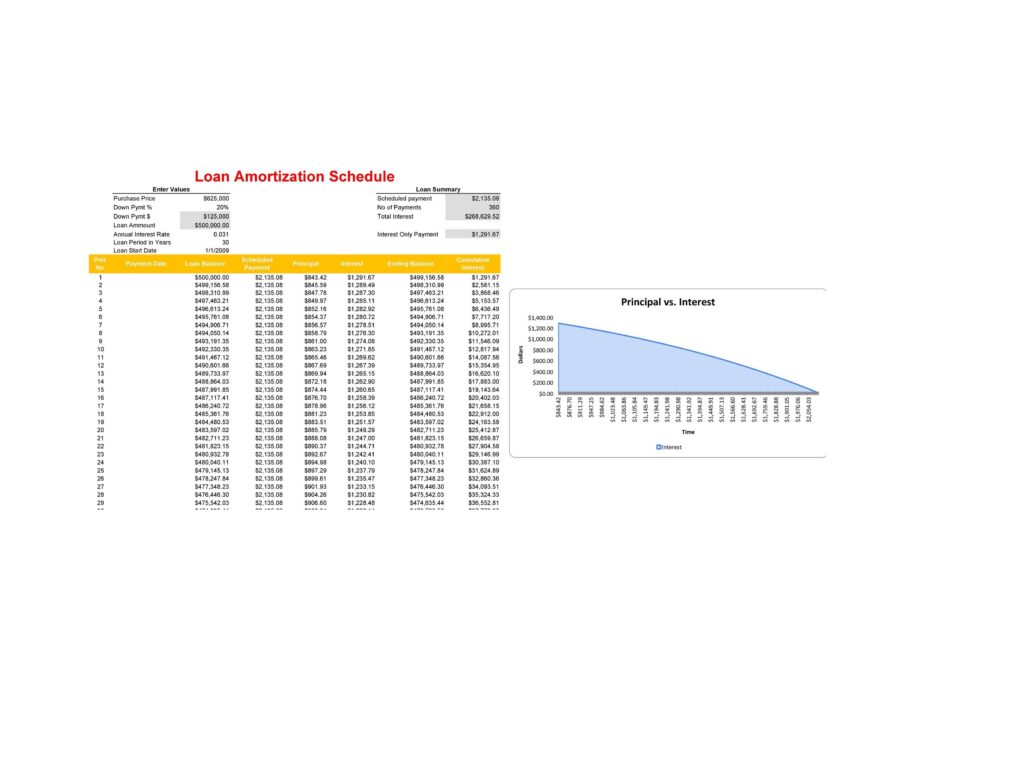

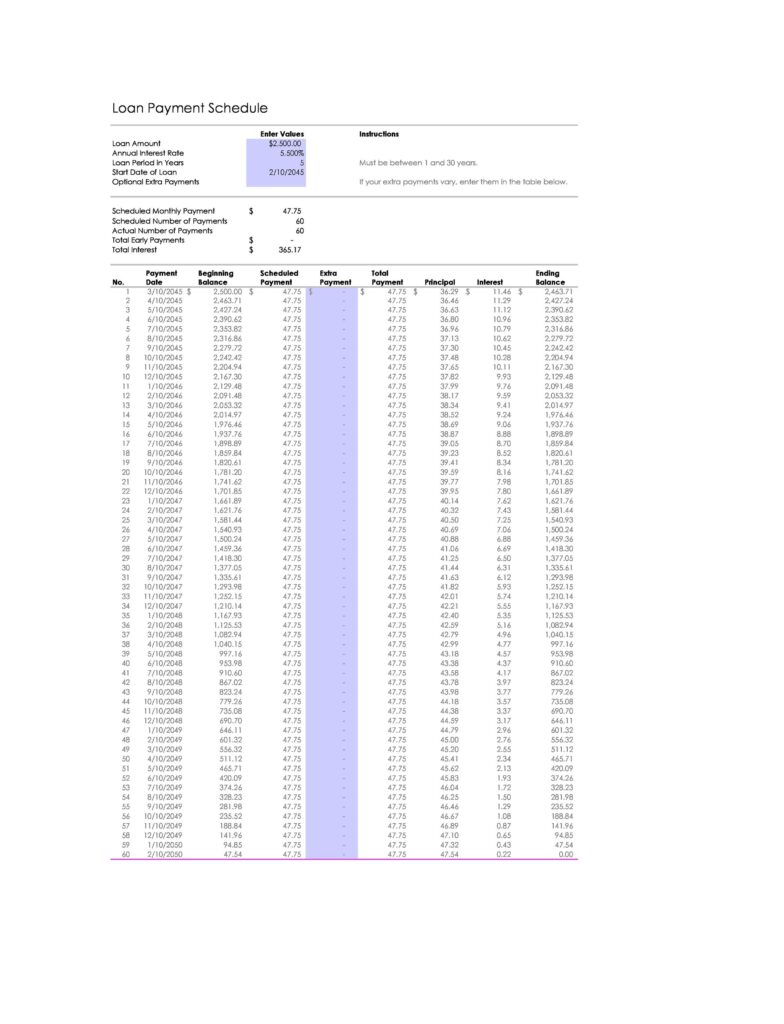

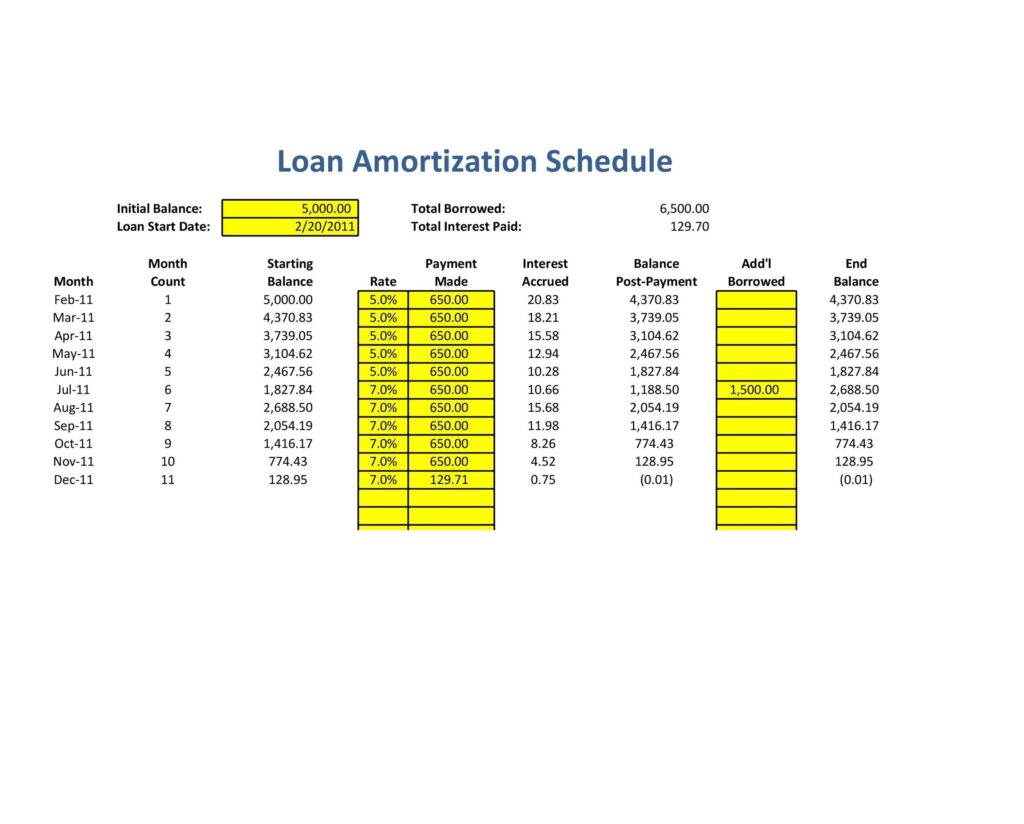

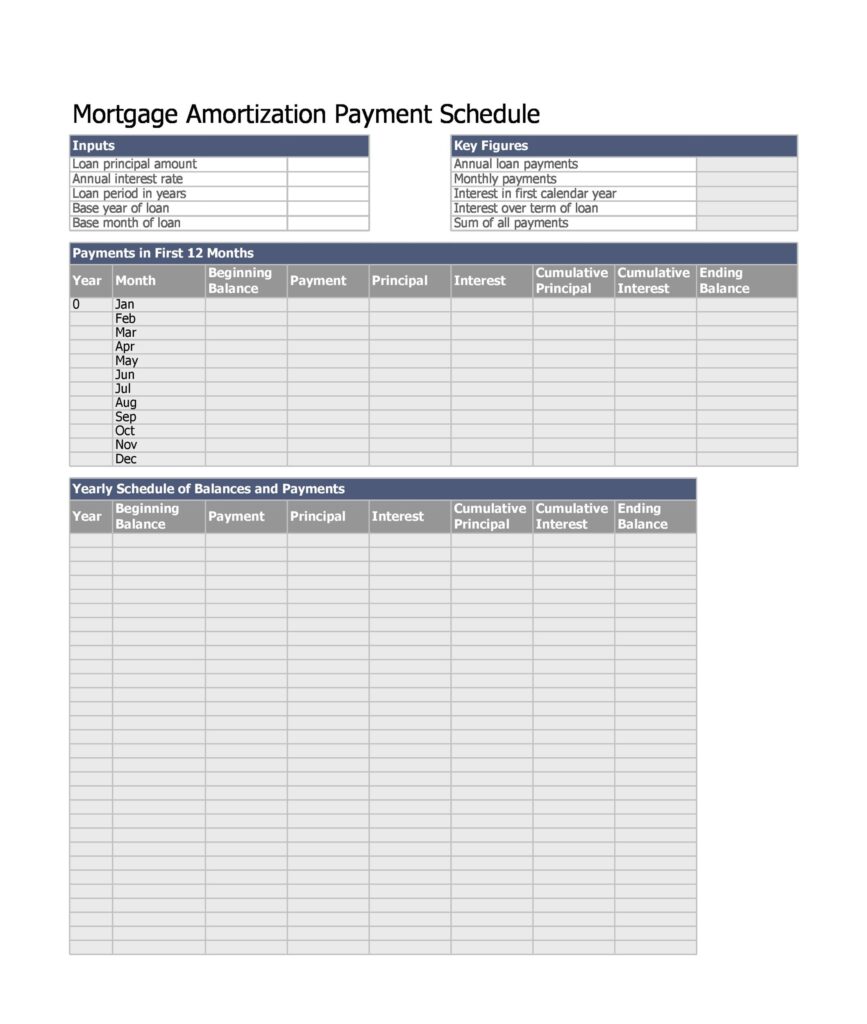

Loan Amortization Schedule

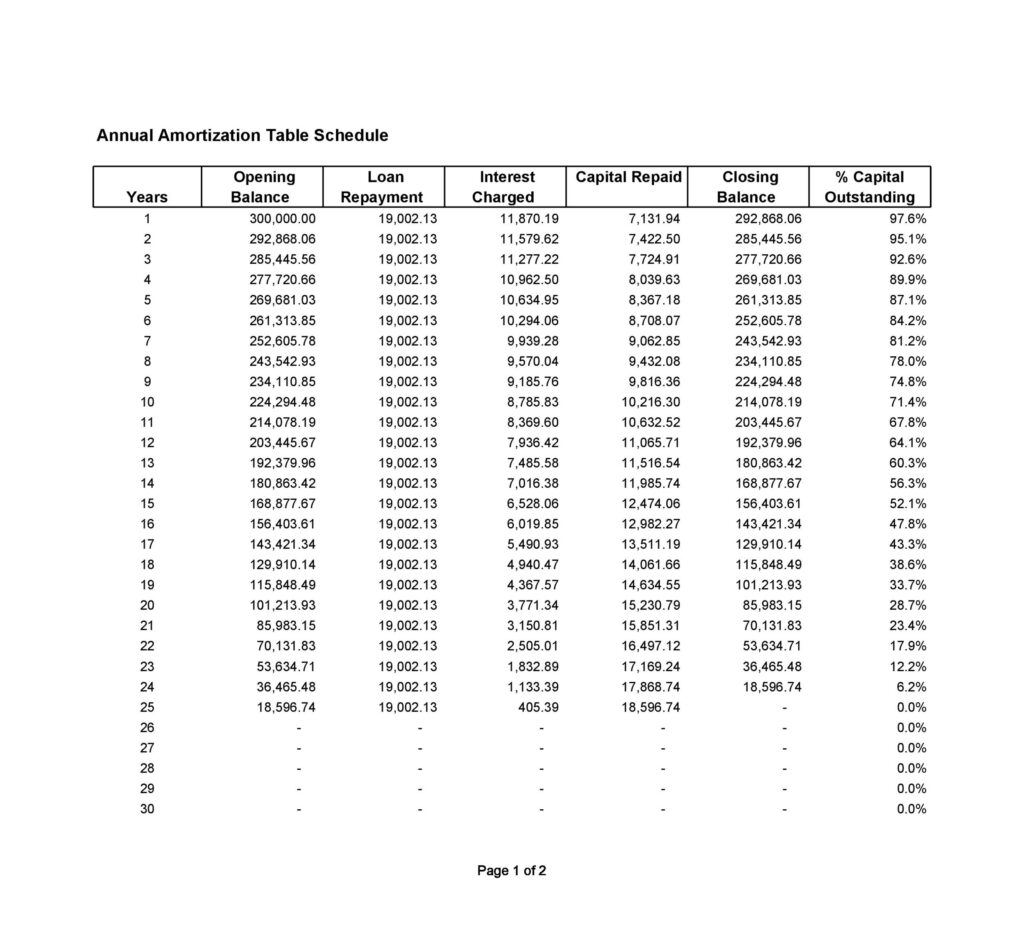

Types of Amortization schedule

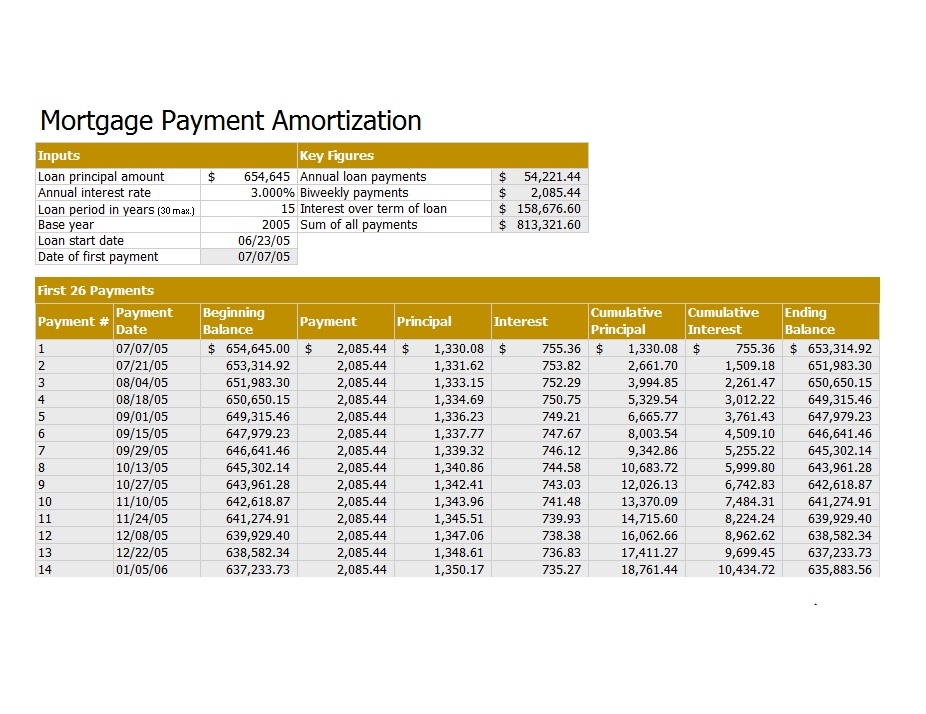

The type of Amortization schedule upon excel is dependent upon just how regularly curiosity is usually exponentially boosted around the loan we. electronic. monthly, weekly or daily. With respect to the type, you may make payments properly based on the compounding curiosity. Right here are the types that you should know.

Daily loan schedule

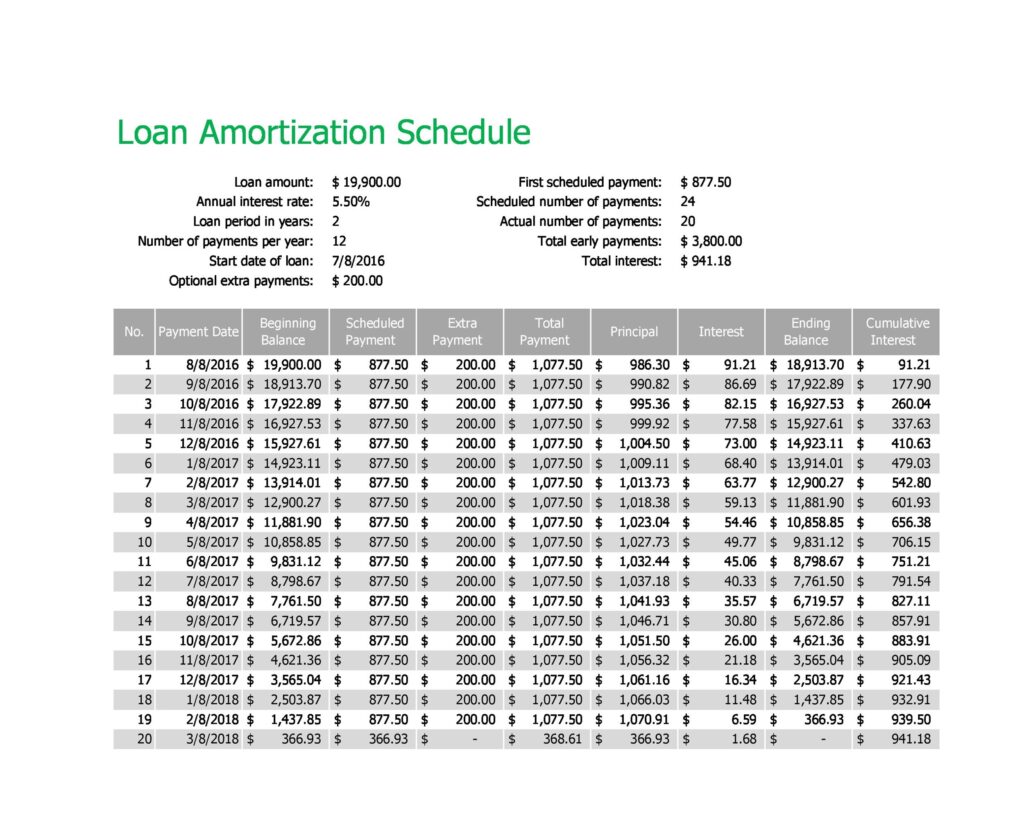

Just like weekly and monthly schedules, the daily loan schedules are short term loan h. They frequently range from a few to 18 weeks. The benefit of the loan supplier is centered on the factor cost which means that you will require to spend back the pace of pennies for the borrowed amount.

Weekly loan schedule

Because the name determines, in weekly loan schedule you need to calculate the loan upon weekly basis. But prior to you consider the dive to function on this all intended for the weekly loan schedule; have to see that you want to take notice of the loan’s rate of recurrence of compounding.

Occasionally, the weekly obligations compound substance curiosity upon a daily basis offering an every week payment strategy to the borrower’s convenience. However, there are some who also offer material interest weekly.

Monthly loan schedule

With this type, the regular multi-year average term loan s having monthly responsibilities. In this kind of monthly schedule, you will certainly have to determine the repaying period on the monthly basis.

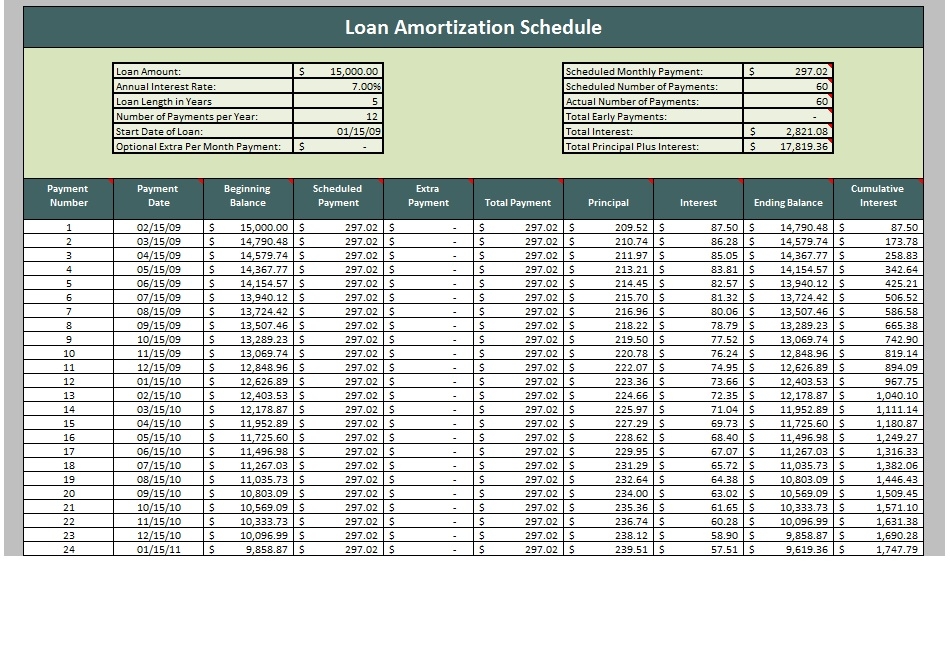

Loan Amortization Schedule Excel

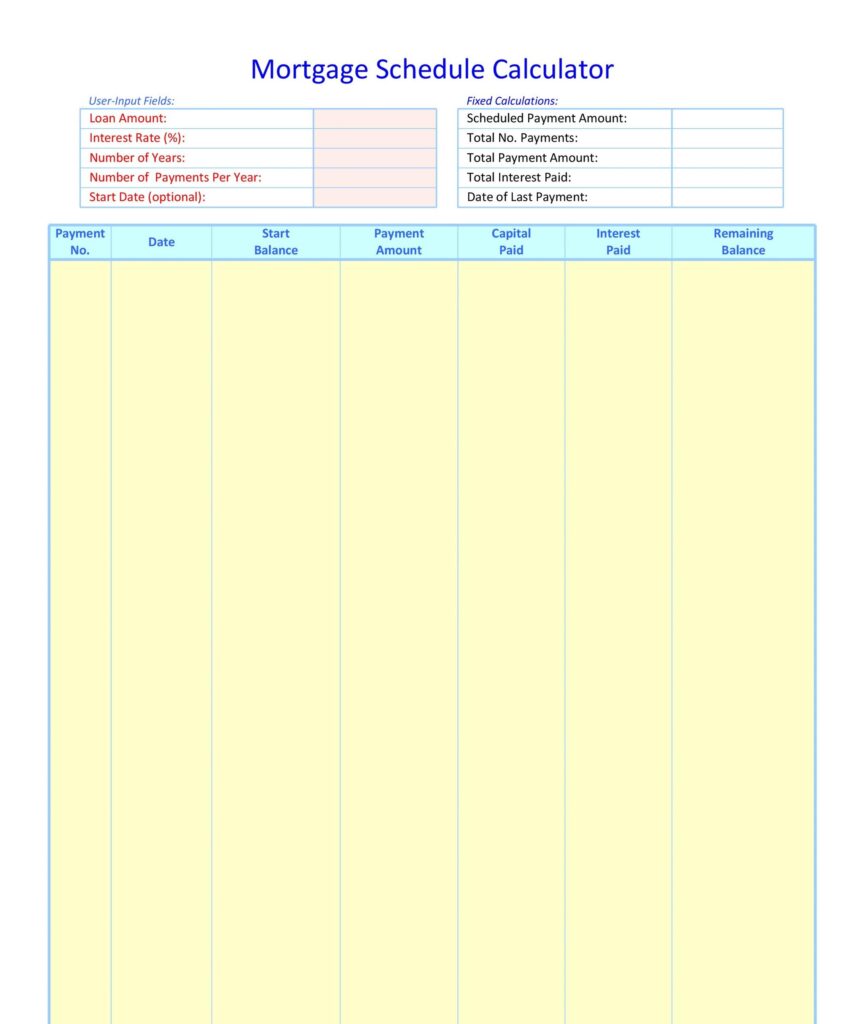

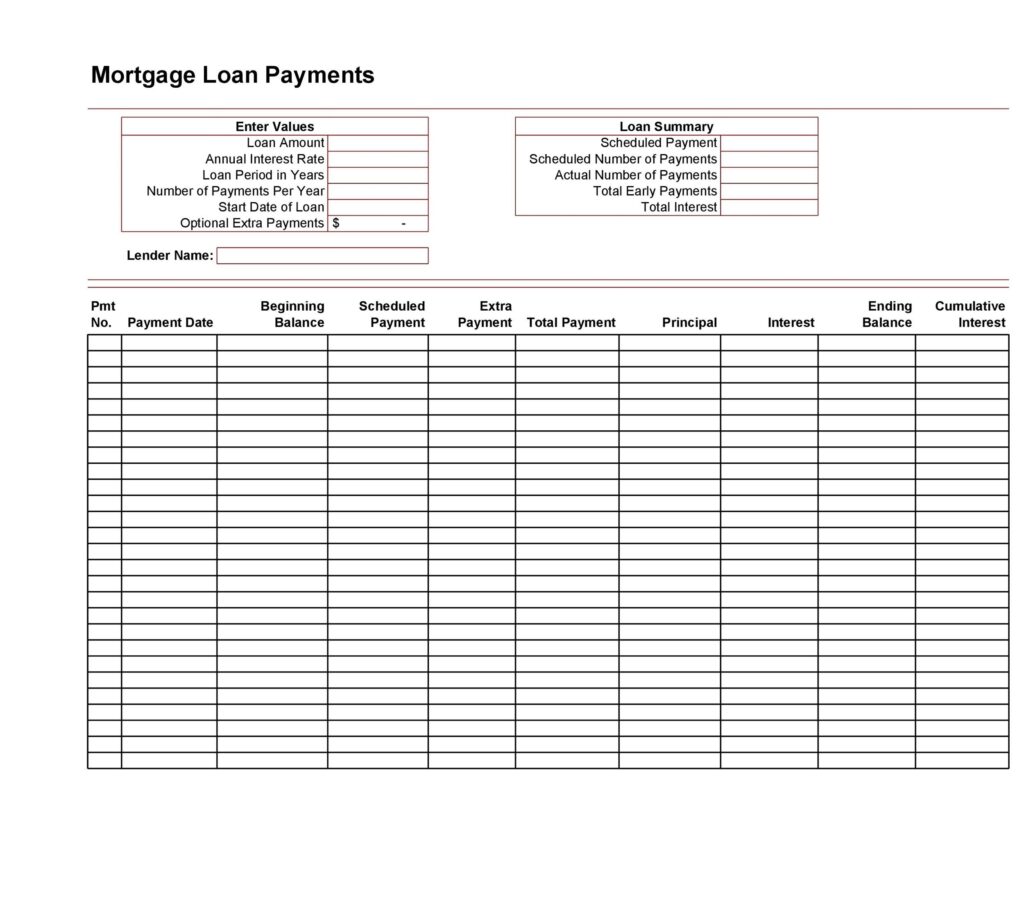

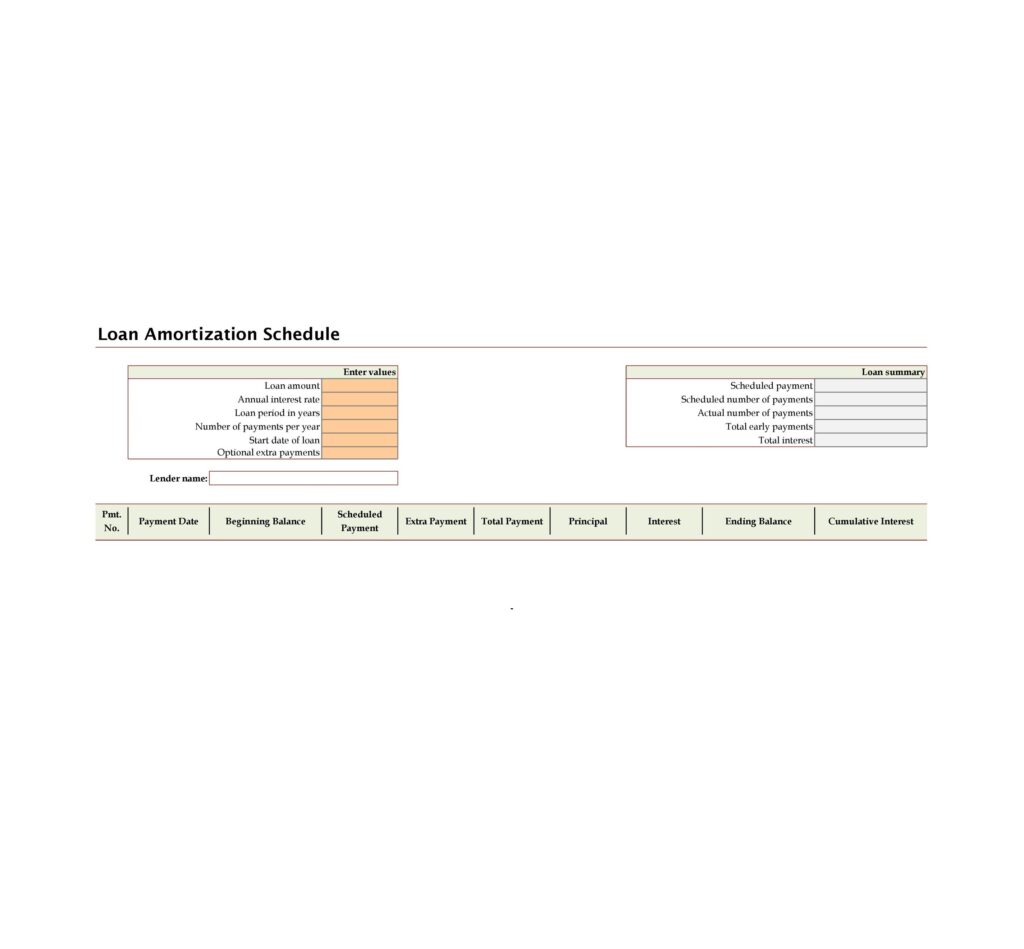

What are the details you need for the Loan Amortization Schedule Template ?

Loan Amount.

Used for this amount and therefore you have to know simply how much Amortization you have to pay to get this kind of a Loan quantity. There is present a cellular in the Loan Amortization Schedule to fill up this volume in. The Template can compute the Amortization Schedule after you have chock-full the outlined cells.

Annual Interest Rate.

Annual curiosity price is usually depending on your credit score. You need to know your interest per annul price to find out your Amortization Schedule and consequently this cell in the Template need to be packed up. Ought to you not really know the interest per annul price that dominates in your Loan, you require to examine your contract or inquire your mortgage provider pertaining to these factors.

Loan period in years.

This cell must be obvious with most the quantity of years you should spend. It is definitely important meant for the Amortization Schedule to be complete of these types of details.

Number of Payments per year.

The Loan Amortization Schedule will possess to determine for the Payment amount and Schedule and as a result this actually is an important fine detail you have got to total.

Start Date of Loan .

This will determine the Date of Payments and therefore this requirements to become chock-full in the Loan Amortization Schedule Template.

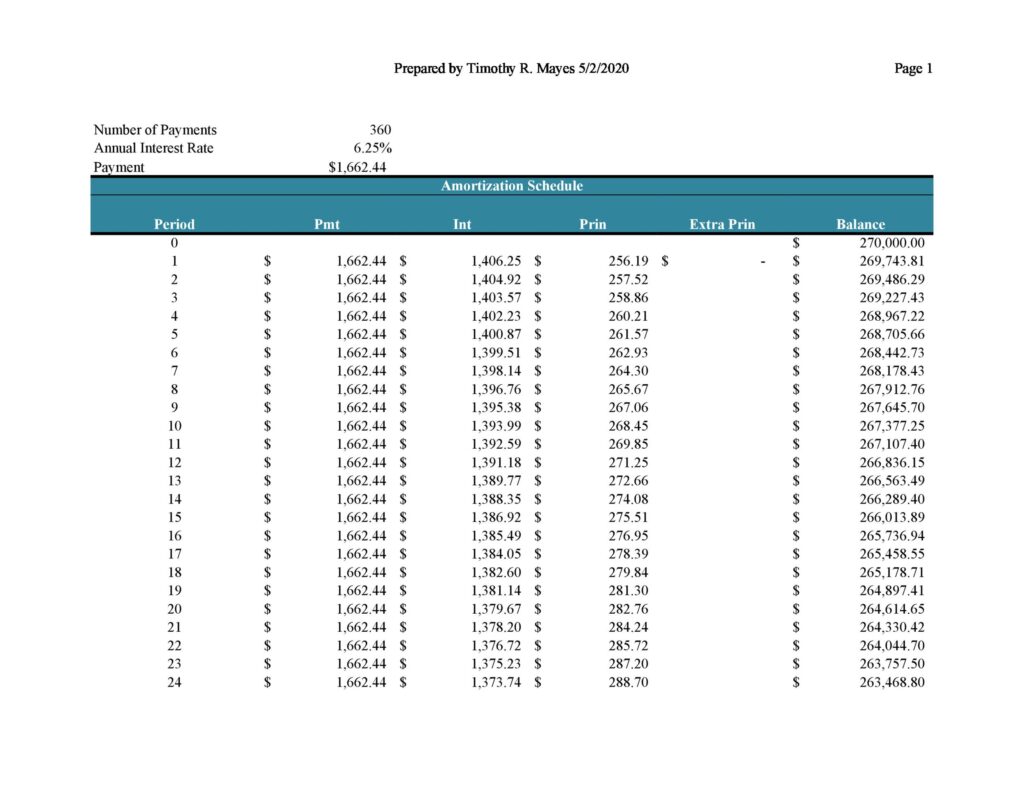

After you possess chock-full the cells relating to the key information mentioned previously, the Template will total the Quantity of Payments, Date of Payment, the running balance of your Loan and the Scheduled Payment.

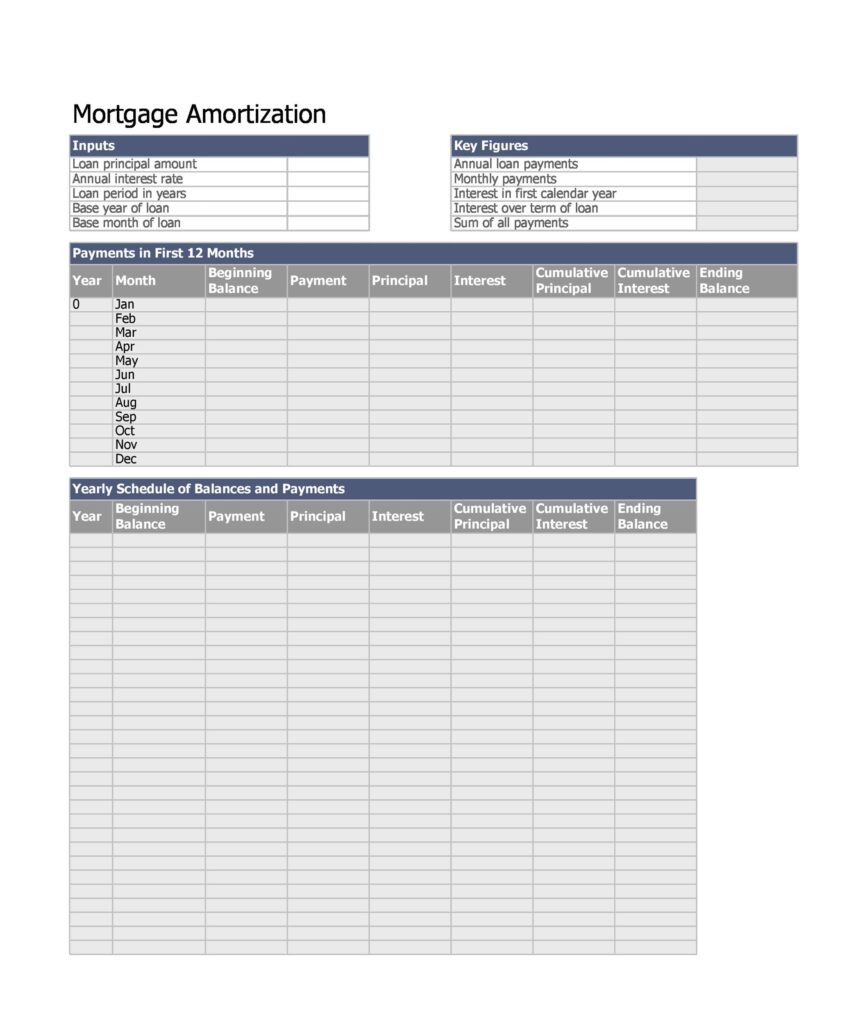

Loan Amortization Schedule Template

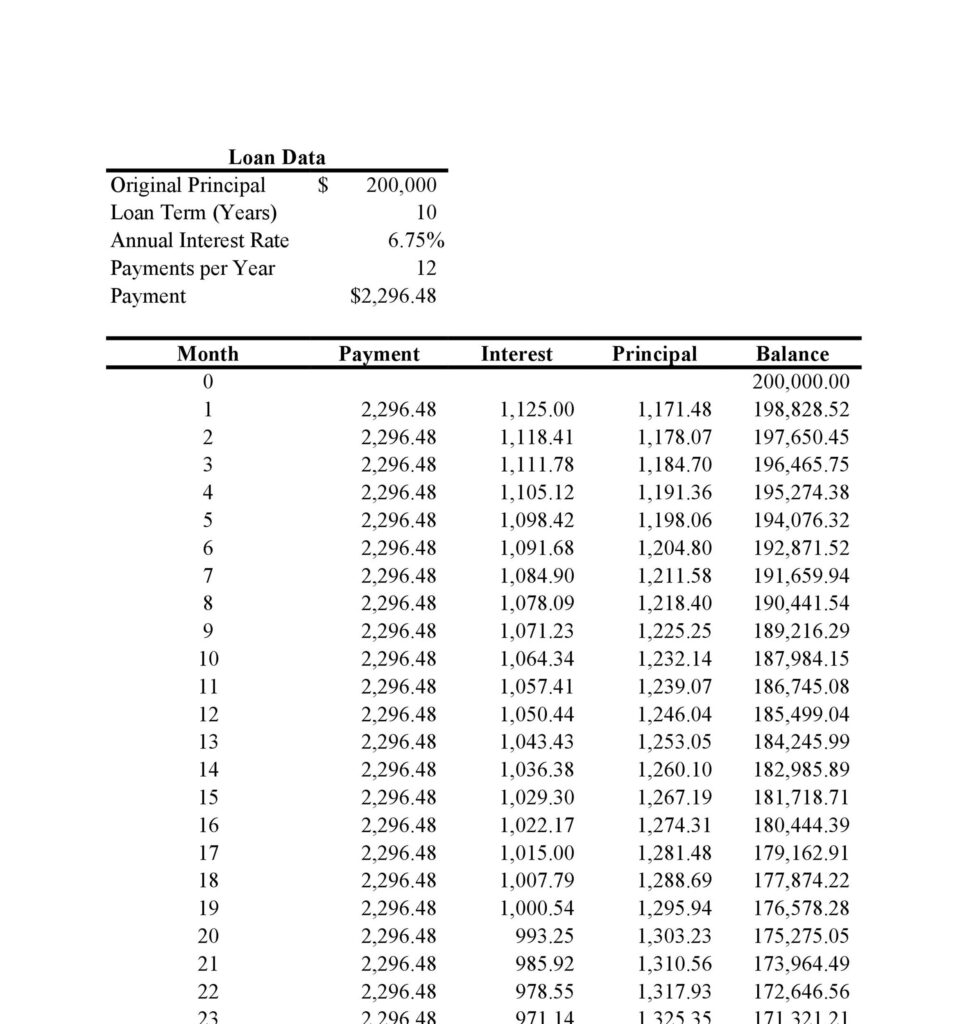

Loan Amortization Schedule Example

Additionally, you will certainly see in the Template the quantity that can be being put on the primary as good as the interest you paid.

The ending balance, which might be the balance of the Loan upon application from the Payment designed for the primary can end up being very clear to you as well.

The total interest can likewise become computed instantly within the Loan Amortization Schedule Template.

With this monitor, you will understand whenever your Payments are because of and precisely how much you will certainly have to pay. Additionally, you will certainly know just how the Payments are applied thus when you will observe higher quantities getting used to the main.

Thus, in case you have extra money you may increase your Payment to finish from the Loan faster. The Loan Amortization Schedule Example will certainly help you make sure you perform not miss a Payment and understand where you are in the Payment Schedule.

Excel has this ready Template you may down weight and as a result monitor your Loan well. By using this Template, you will end up being able to keep a good credit standing and sooner, acquire your long-term Loans in better prices.