Student Loan Application Form is usually provided to students for which usually they might be anticipated to benefit to spend off education-related expenses, such as university or college fees, books, and space and table at the college or university. Many of these types of loans are offered to Students at a lessened curiosity rate, mainly because well because the effectivity from the loan Application would become produced even more feasible when you download the Printable Student loan Application form.

Students loans are essentially non-dischargeable, nearly everyone knows this. Presently there are many very particular circumstances precisely where actually today you could possess your Students loan debt discharged, however, that is usually a thin exclusion that needs a battle and cash to battle. All of us will certainly talk about the present condition of release capability in a long-term post.

The scenery about Students loans and personal bankruptcy has not really been therefore destitute. Not so sometimes ago these types of loans were dischargeable. Back when these had been dischargeable, the price of education was decreased, and the total Students loan debt was obviously a fraction of what this is right now. With Students loan debt currently becoming a 1, 2 100, 000, 500, 000. 00 (One Trillion Two 100 Billion) buck issue keeping people back again from purchasing homes or getting included in the wider overall economy, after a few help they will become dischargeable however again.

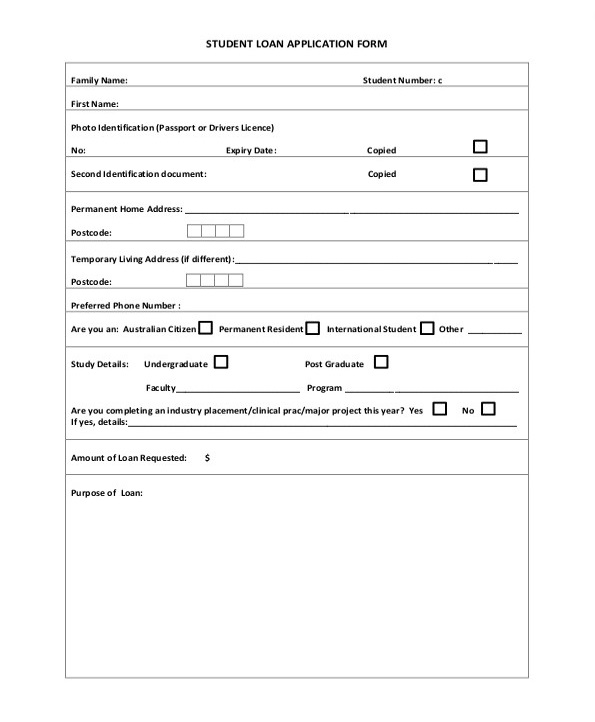

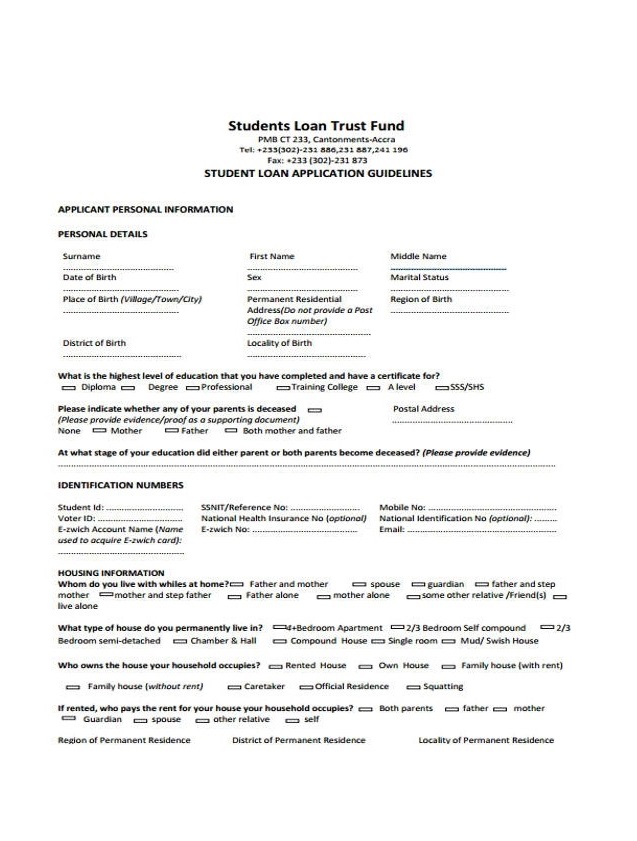

Printable Student Loan Application Form

Student Loan Application Form

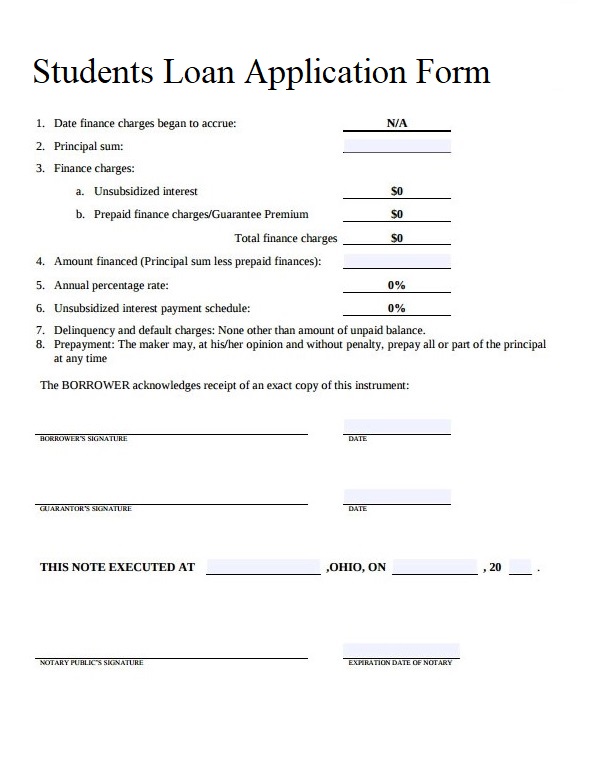

Download Students-Loan-Application-Form

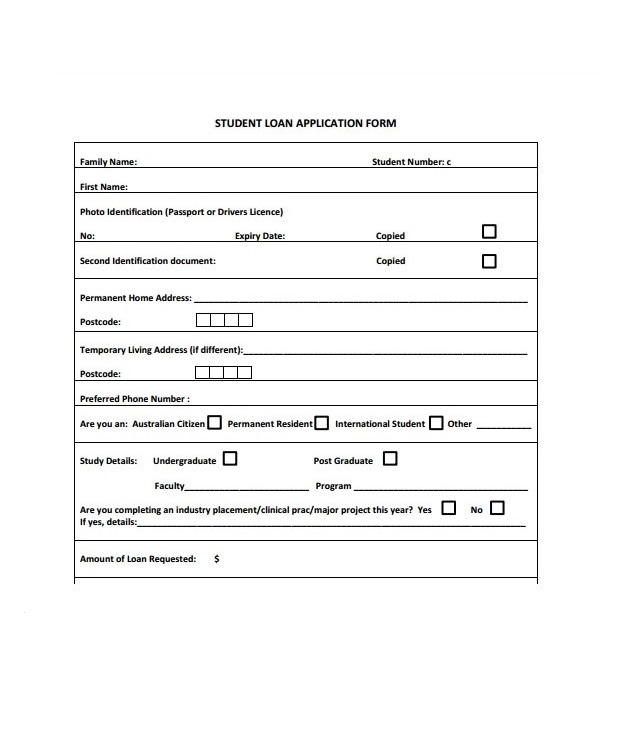

Sample Student Loan Application Form

Download Sample-Student-Loan-Application-Form

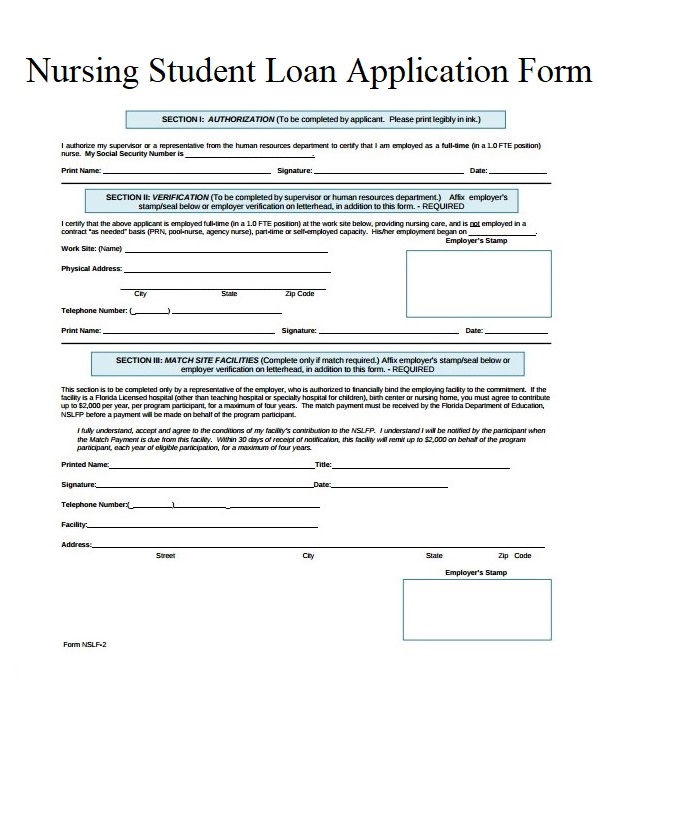

Nursing Student Loan Application Forms

Download Nursing-Student-Loan-Application-Form

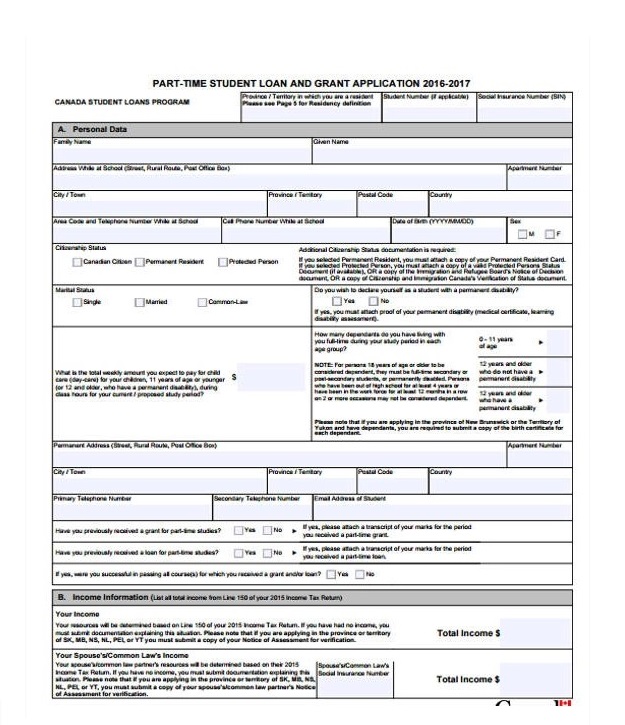

Part Time Printable Student Loan Application Form

Download-Part-Time-Student-Loan-Application-Form

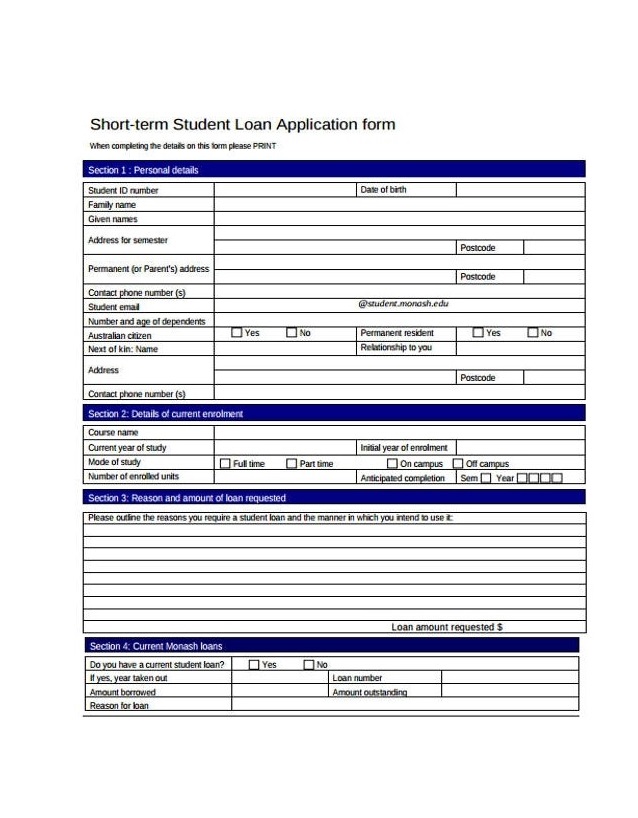

Short Term Student Loan Application Form

Short-Term-Student-Loan-Application-Form

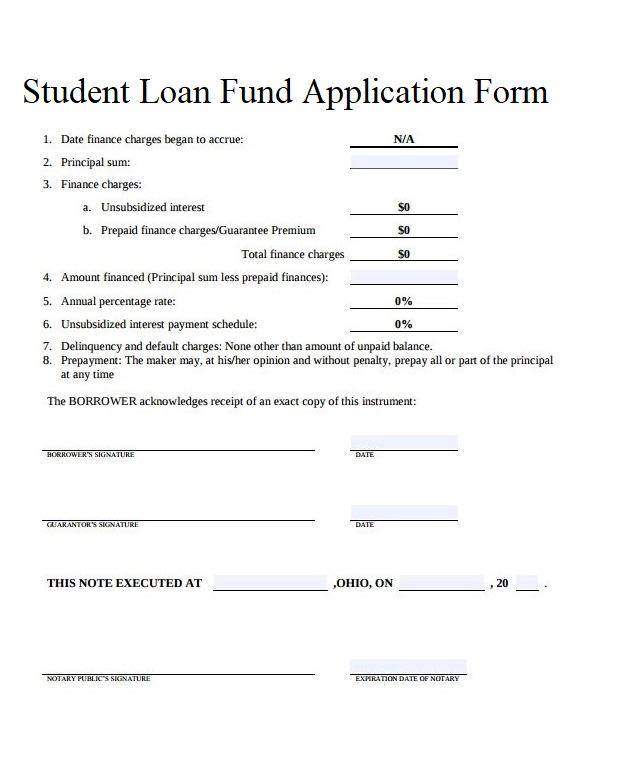

Student Loan Fund Application Form

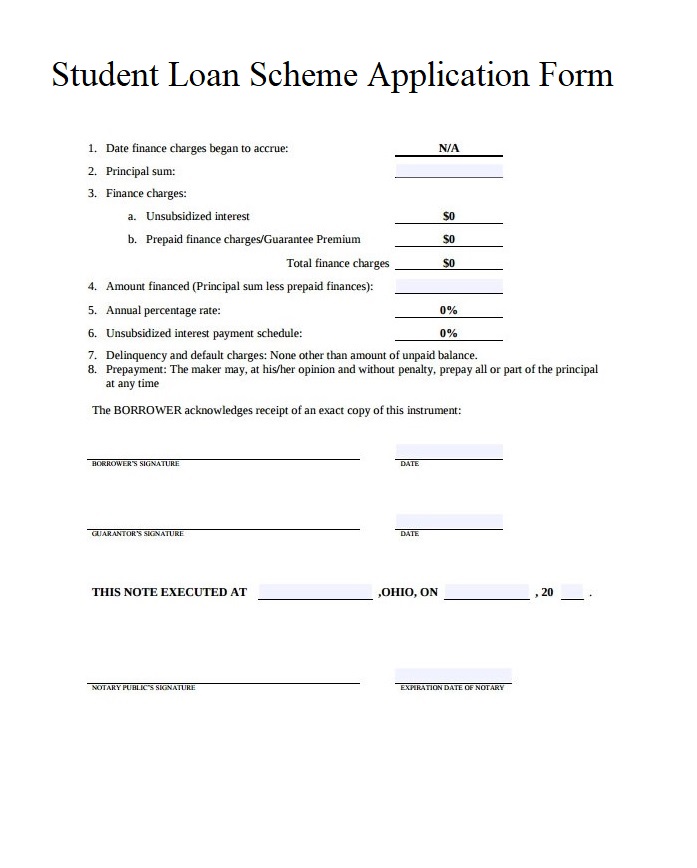

Student Loan Scheme Application Form

Student Loan Trust Fund Application Form

Generally, Students are not really actually required to pay these types of loans till the end of the provided elegance period, which frequently begins once they have got completed their particular college, or to become more particular, whenever they get their particular first function right after graduation.

Step Procedure in Student loan Application

We almost all possess dreams to run after, desire to go after, and obligations to satisfy. Essentially the parents and family users that all of us try extremely hard to have got the best of education in order to hasten the potential and gain existence learning runs into. Through this, we are geared to encounter life’s most demanding hurdles.

You are believed lucky and happy in case you fit in to the few who also are blessed with certain and steady financial resources. Nevertheless, most of the Students nowadays bear the same concern – moderate financial ability. Everybody desires to total their education or at least possess got guaranteed resources to finish their education. Simply by saying consequently, you are one of these Students too.

The student has Different kinds of requirements. At the tertiary level, school lifestyle and college tuition charges when mixed can produce a big crater of financial issues. Student entails themselves in diverse existence circumstances to provide for his or her education. There are numerous possibilities out there however none of these are instant, lengthy-term, and dependable in comparison to Student loans.

Different Types of Student Loans

Student financial loans might be the borrowed money to pay out for educational needs and daily expenses in your period while a university or college Student. They will be expenses costs, lab charges, boarding college costs sometimes travel, and meals expenditures.

Student loans come in Different types seeing that well this kind of while Federal student loans and printable student loan Application form.

-

Federal Student loan

Because the term suggests, Federal Student financial loan is usually a kind of plan provided by the Federal government to understand the Student is right to quality education. Therefore, Federal Student loans are financed simply by the government even though offering little curiosity benefits.

debt repayment happens just six weeks after graduation. Federal loans have Stafford and Kendrick loans beneath their belt. Stafford loans are for every Student no matter financial capacity while Kendrick law is awarded to students with high educational necessity and assistance. Both types of loans increase an optimum of 5% interest every year whilst a general total of dollar twenty, 500 may be given from these types of loans.

The great thing about this loan is these types will not require a credit score looking at nor a credit background. To ask in form rules or to get access to this type of loan, the customer should proceed instantly and organize with the university’s financial help office.

-

Private Student loans

As mentioned, private Student loans are solutions offered simply by the private sector or the corporate and business owners. In comparison to other loans, private Student loans gain a modest amount of interest. When applying intended for a private printable student loan Application form, the debtor needs to mainly Student the fundamental characteristics from the loan this kind of as prices of curiosity, payment options, incentives, and origination charges. The customer should also consider possible income sources when debt repayment takes place.

When applying for a private Student help loan, the borrower might search the web, appear at classified ads or talk to dependable people to select from numerous funding businesses that offer this type of support.

When you have chosen the financing company to supply with the loan, you must stick to the regular that they will be arranged. They will many possibly consider an appearance at your credit background and can easily ask to get files that will show that your credit score is genuine.

If you avoid having a credit background, they are going to require you of a cosigner that will discuss your responsibility to debt repayment. When they will certainly not accept the printable student loan Application form, it simply means that your credit track record is poor that it will are unclear that you can send back your debt.

The Advantages of Having Student loan forms

Colleges want to help to make sure these types of Students determine what this means to consider a Student loan. You can find forms this kind of because Student loan Personal Contract forms to make sure that these types of Students consider these loans.

These are to make sure that they will have the ability to continue their particular education inside the school and know what they’ll require to perform so that they can be capable to pay back it.

These types of assists established the conditions and circumstances that requirements to end up being agreeable to both the student and the university. This ought to demonstrate help to both schools since well because of the Student. 1 party reaches become able to continue his or her research, whilst the additional can offer the teaching the Student needs for any much lighter tomorrow.