A simple income statement template helps track income and expenses. It’s a crucial tool for understanding financial health. Here’s everything you need to know.

What is a Simple Income Statement Template?

It is a pre-made form for recording financial transactions. It shows revenue, expenses, and net income, simplifying financial tracking and reporting.

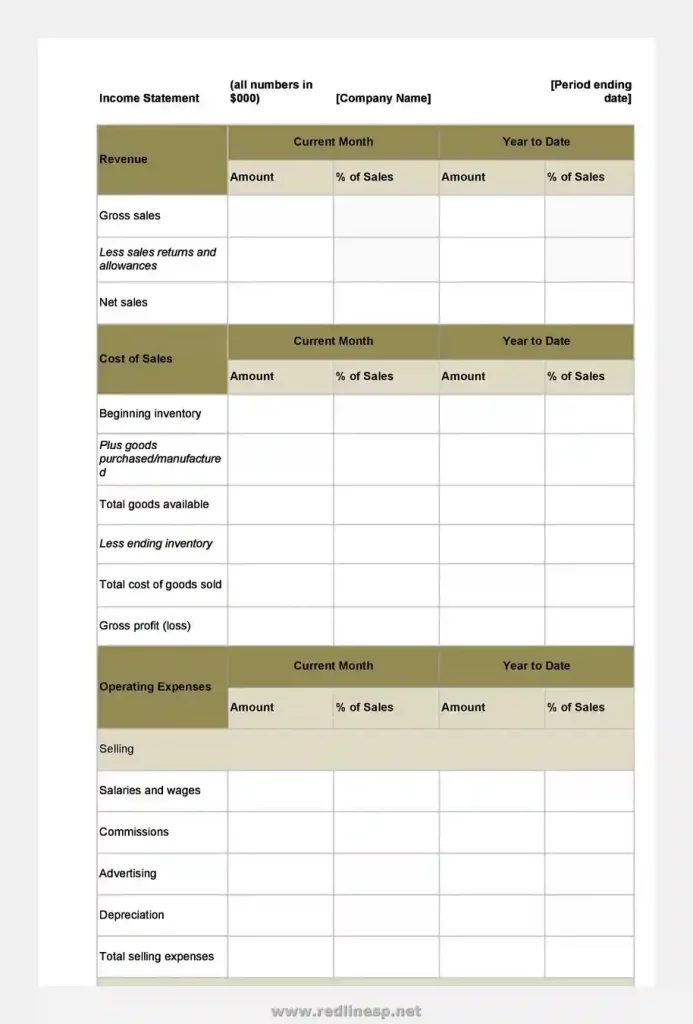

Key Components of an Income Statement

Here are the key parts:

- Revenue: Money you make from selling goods or services.

- Expenses: Costs to run your business, like rent, supplies, and salaries.

- Gross Profit: Money left after paying for the costs of making your product.

- Operating Expenses: Costs to run your business, not including product costs.

- Operating Income: Money left after subtracting operating expenses from gross profit.

- Other Income and Expenses: Money earned or spent outside your main business.

- Net Income: Final amount after subtracting all expenses from total revenue.

Types of Income Statements

There are many types of income statements. Each one is useful for different purposes. Here are some common types:

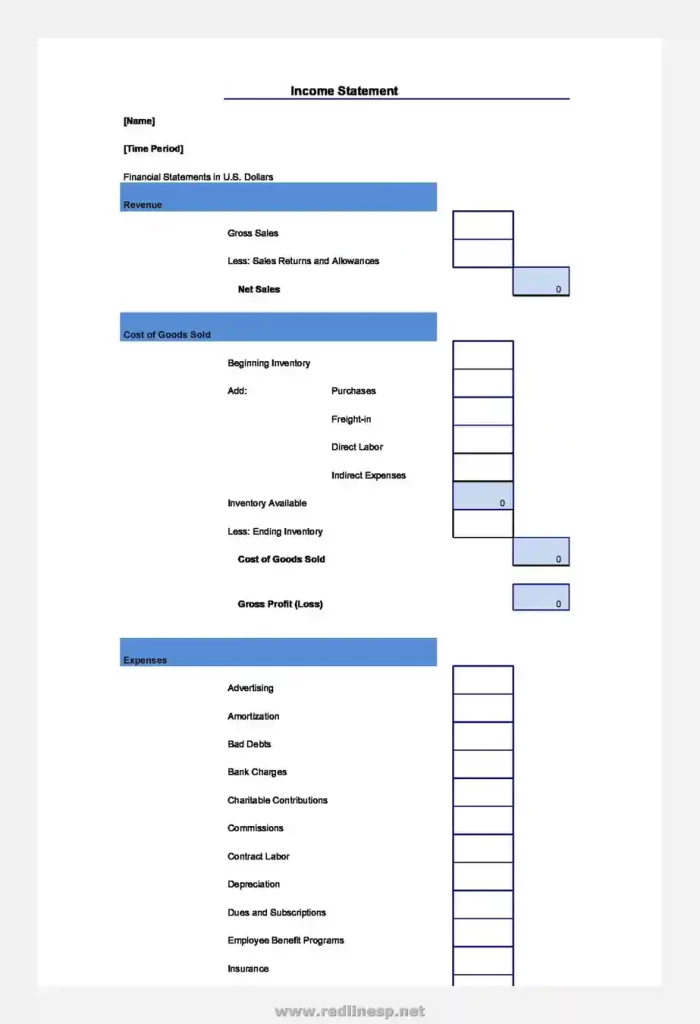

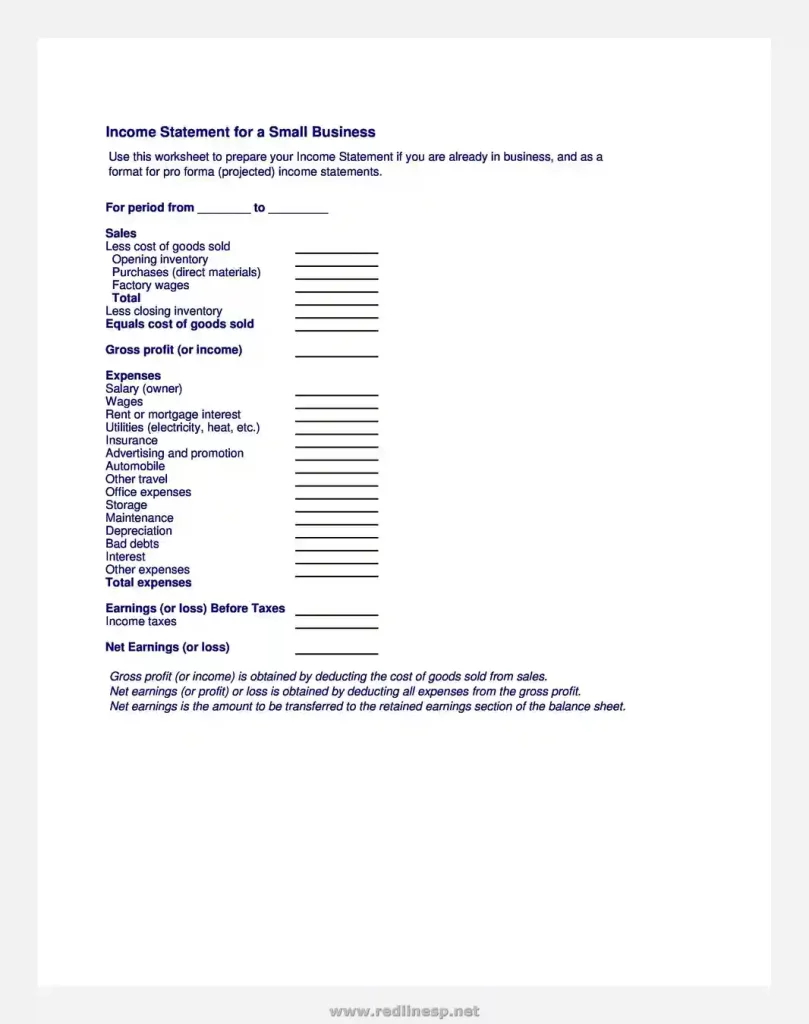

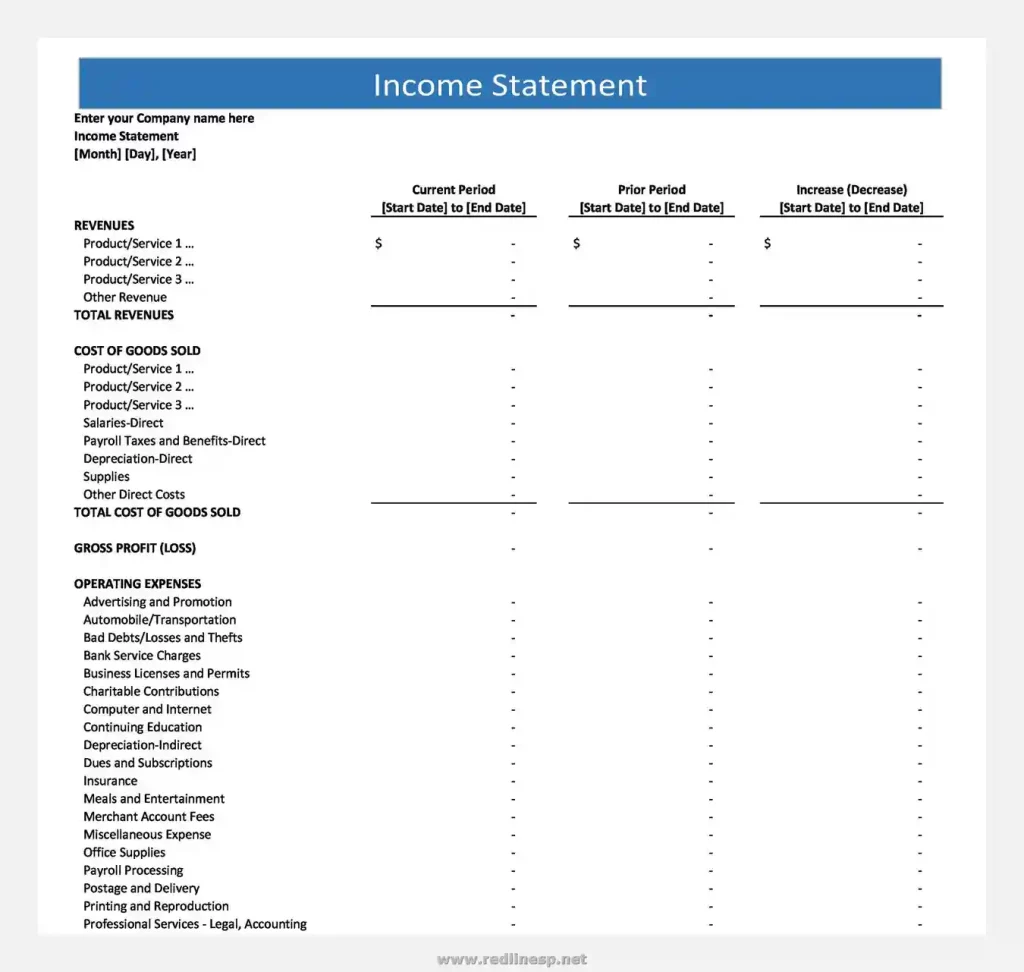

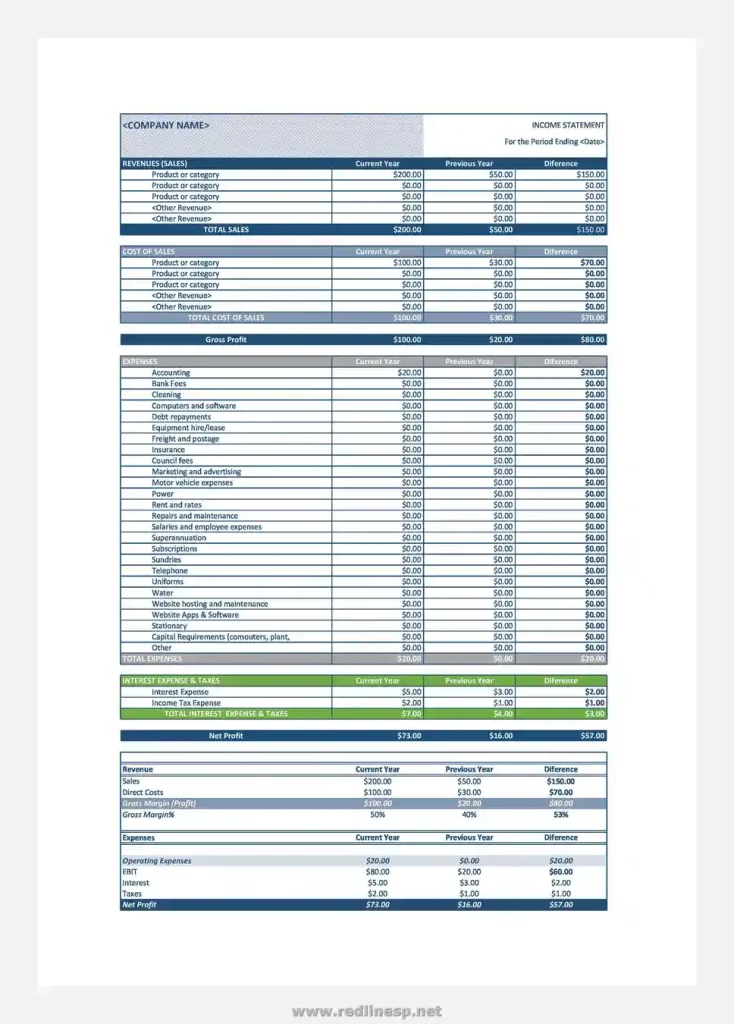

- Simple/Basic Income Statement

- What It Is: This is the most basic type of income statement. It shows your total revenue, total expenses, and net income.

- Use: It is excellent for small businesses and personal finances because it is easy to understand.

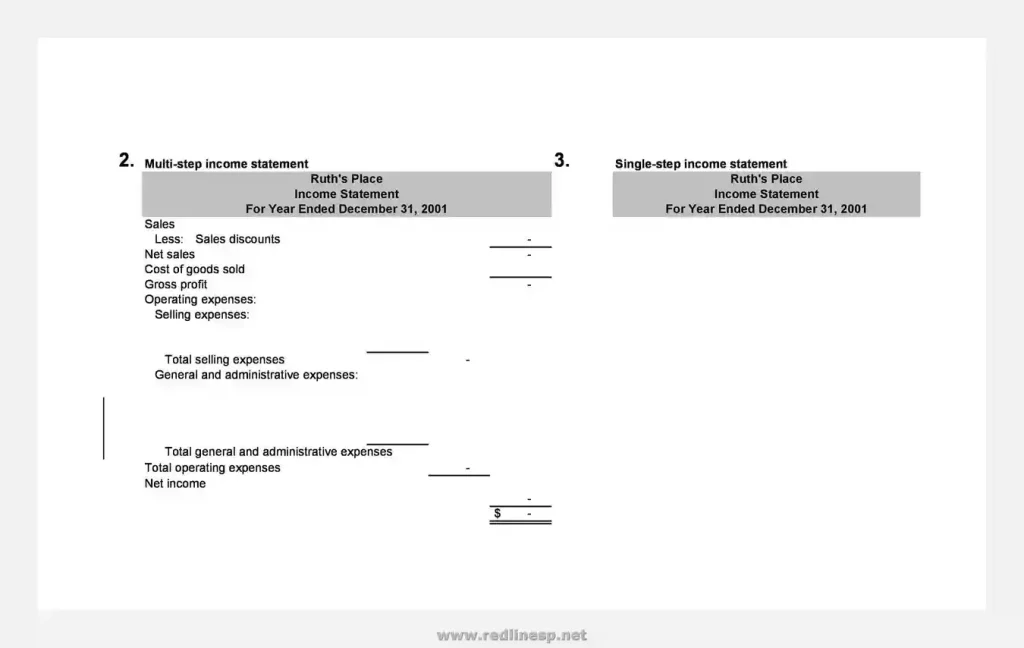

- Single-Step Income Statement

- What It Is: This type adds all revenues and subtracts all expenses in one step.

- Use: It is simple and easy to use, making it suitable for small businesses.

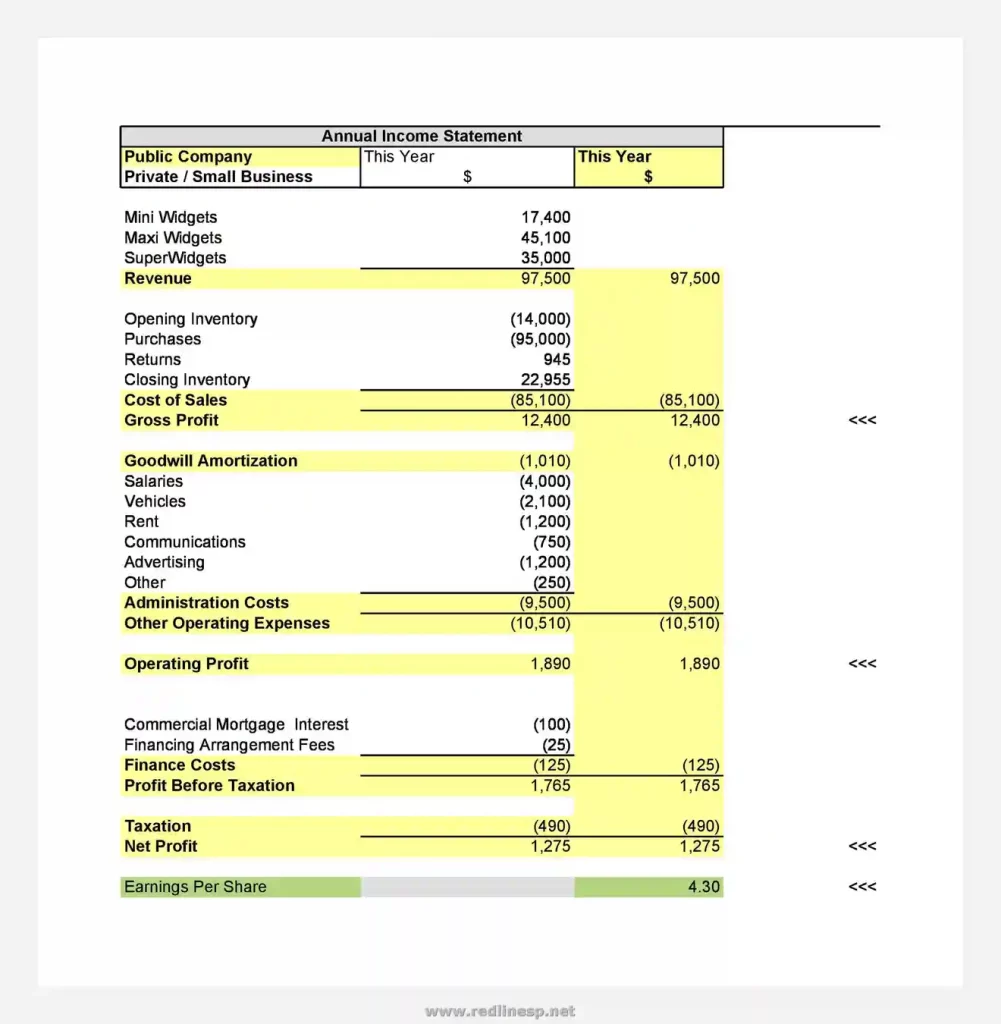

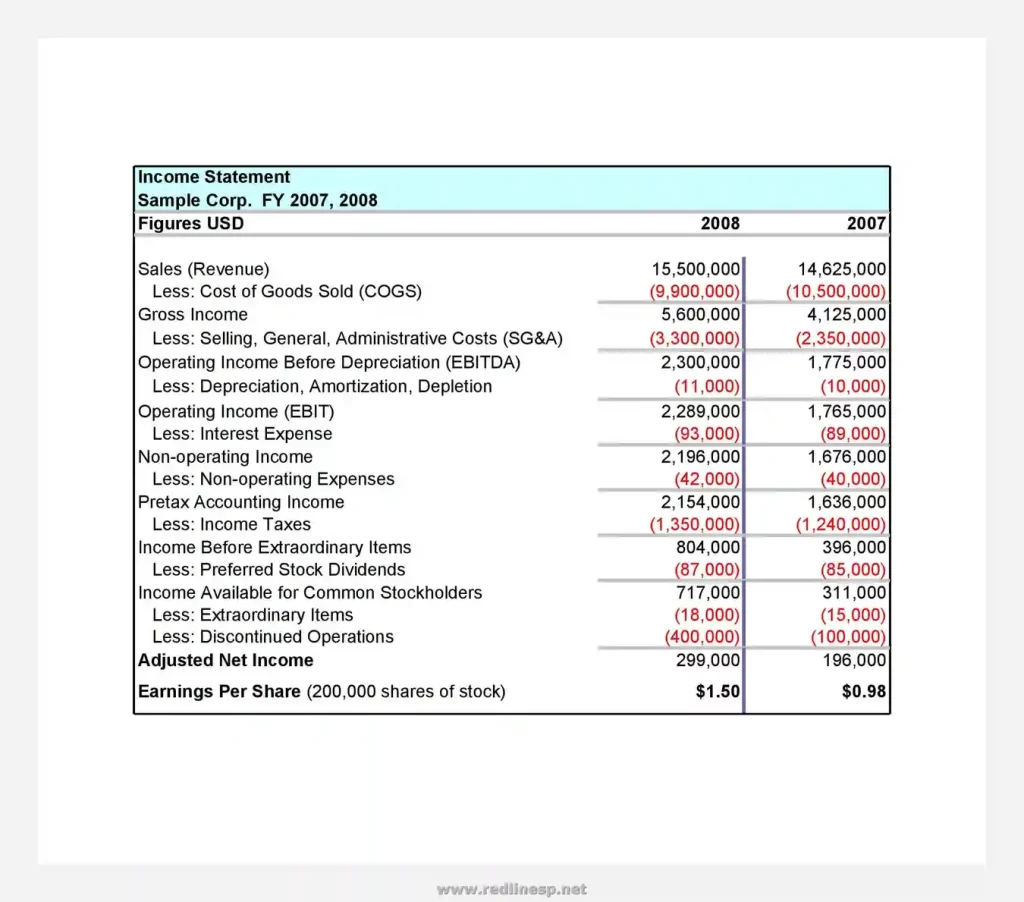

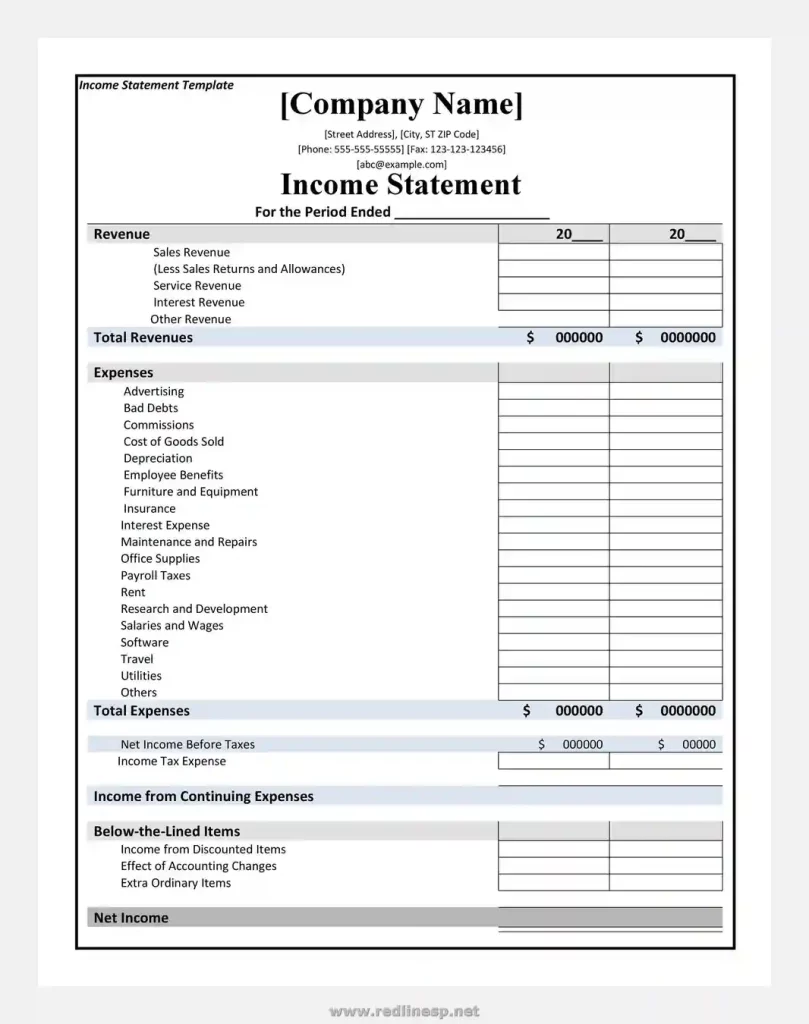

- Multi-Step Income Statement

- What It Is: This type separates operating revenues and expenses from non-operating ones. It shows gross profit and operating income.

- Use: It provides more detail and is helpful for larger businesses.

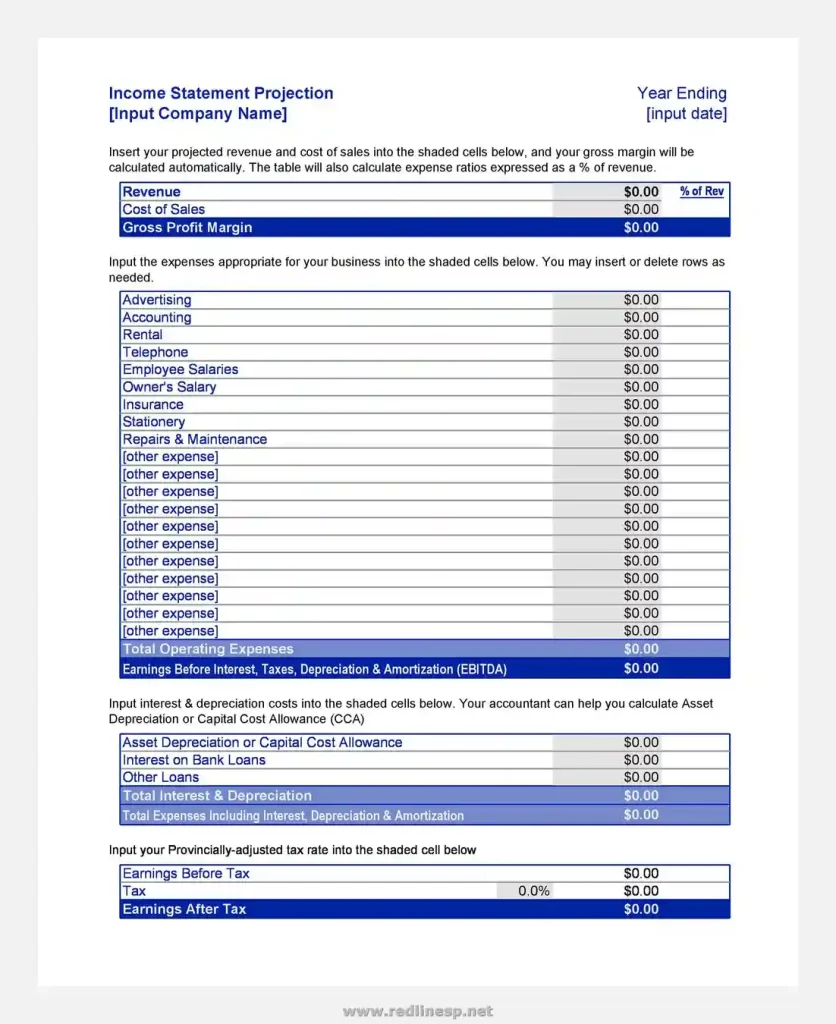

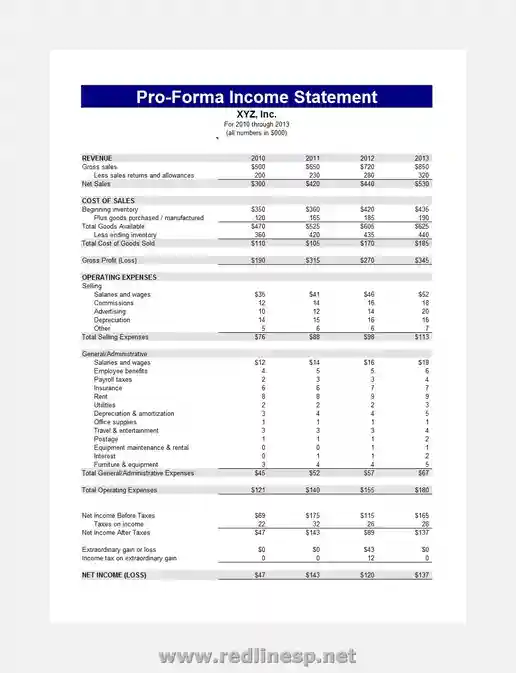

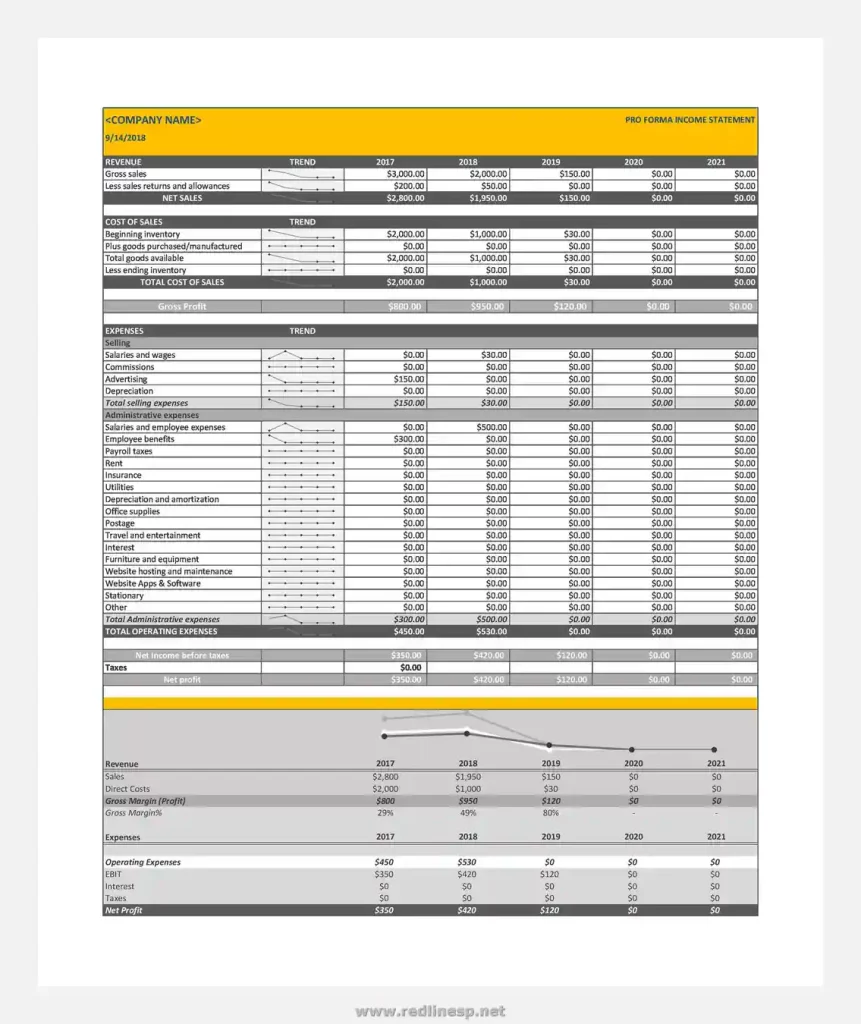

- Pro forma Income Statement

- What It Is: This type predicts future income based on certain assumptions.

- Use: It helps plan and make financial decisions.

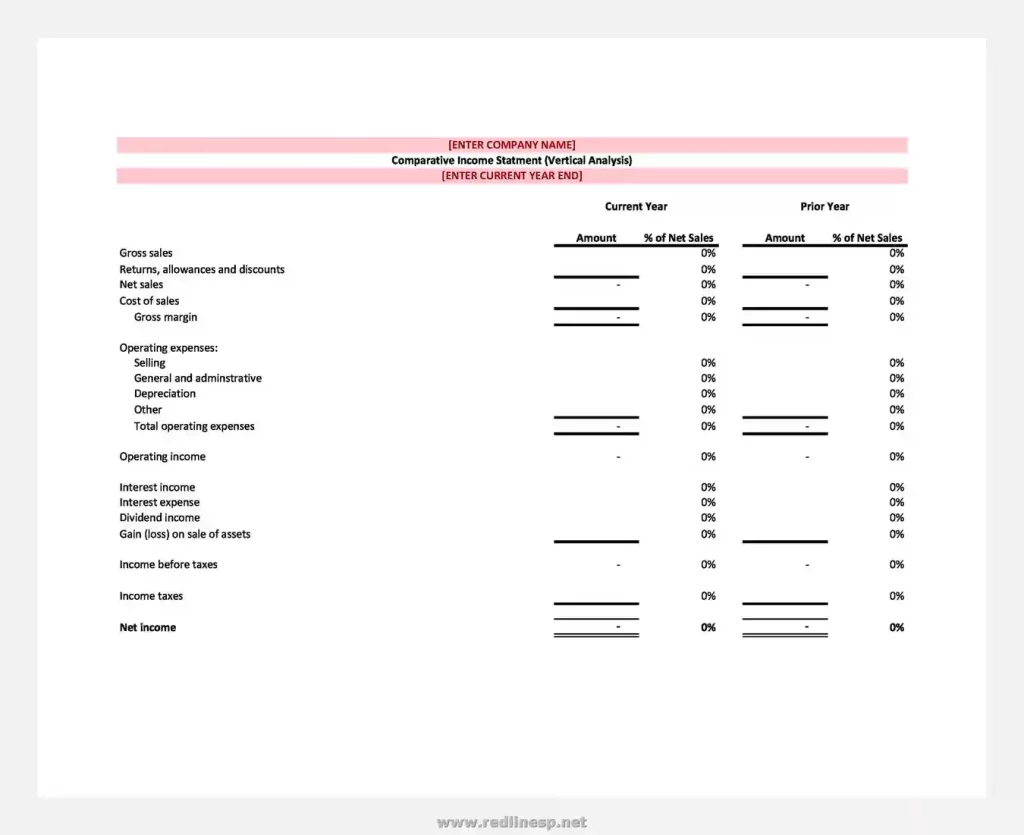

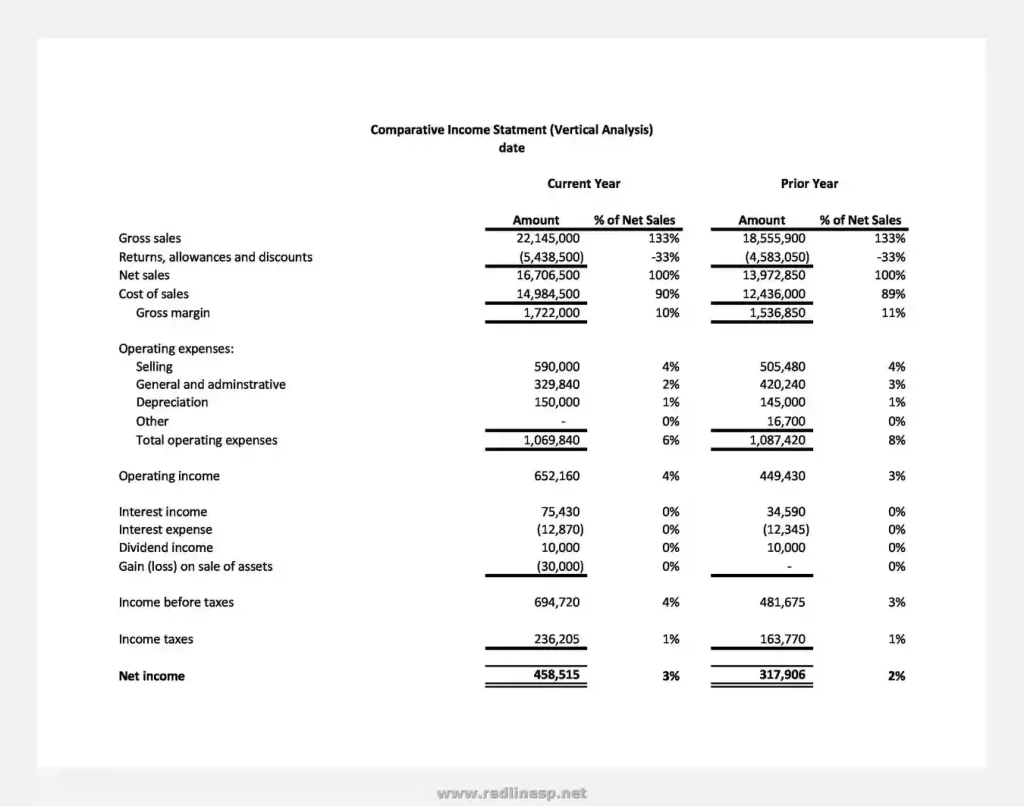

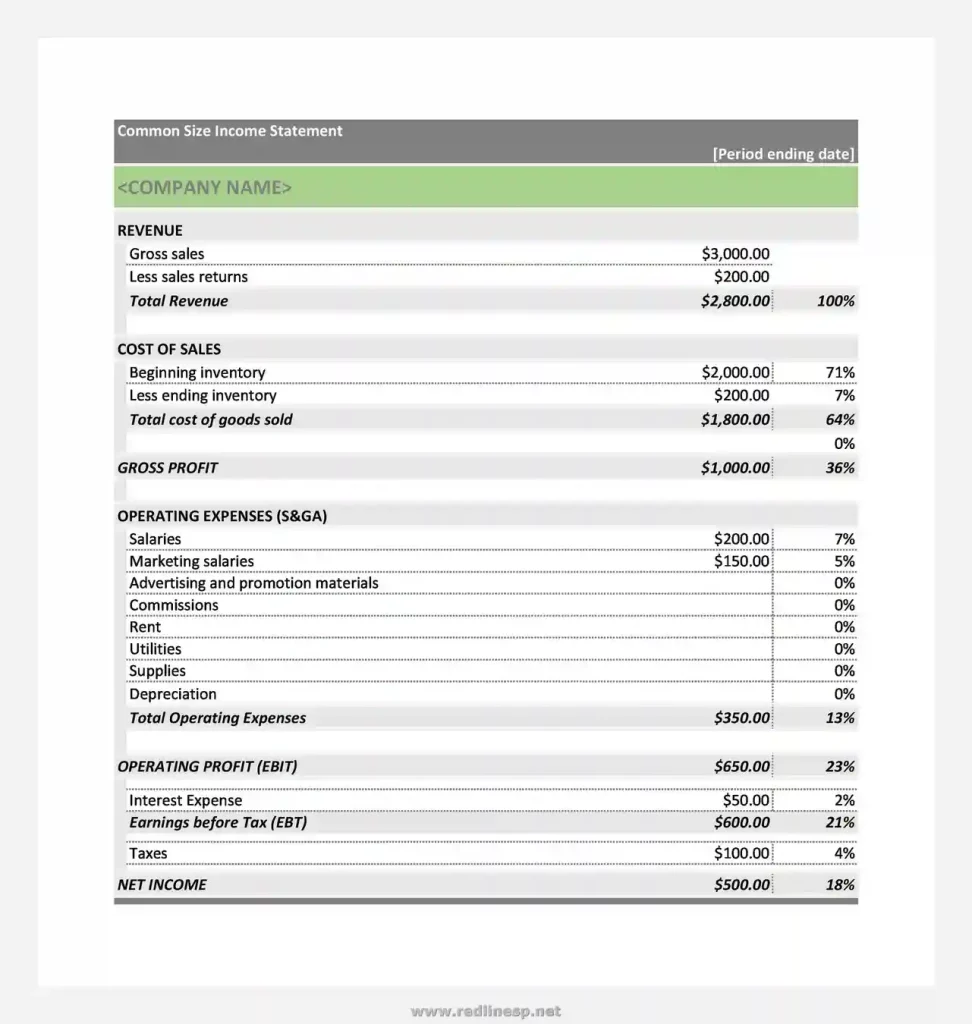

- Common Size Income Statement

- What It Is: This type shows each item as a percentage of total revenue.

- Use: It helps compare financial performance over different periods or with other companies.

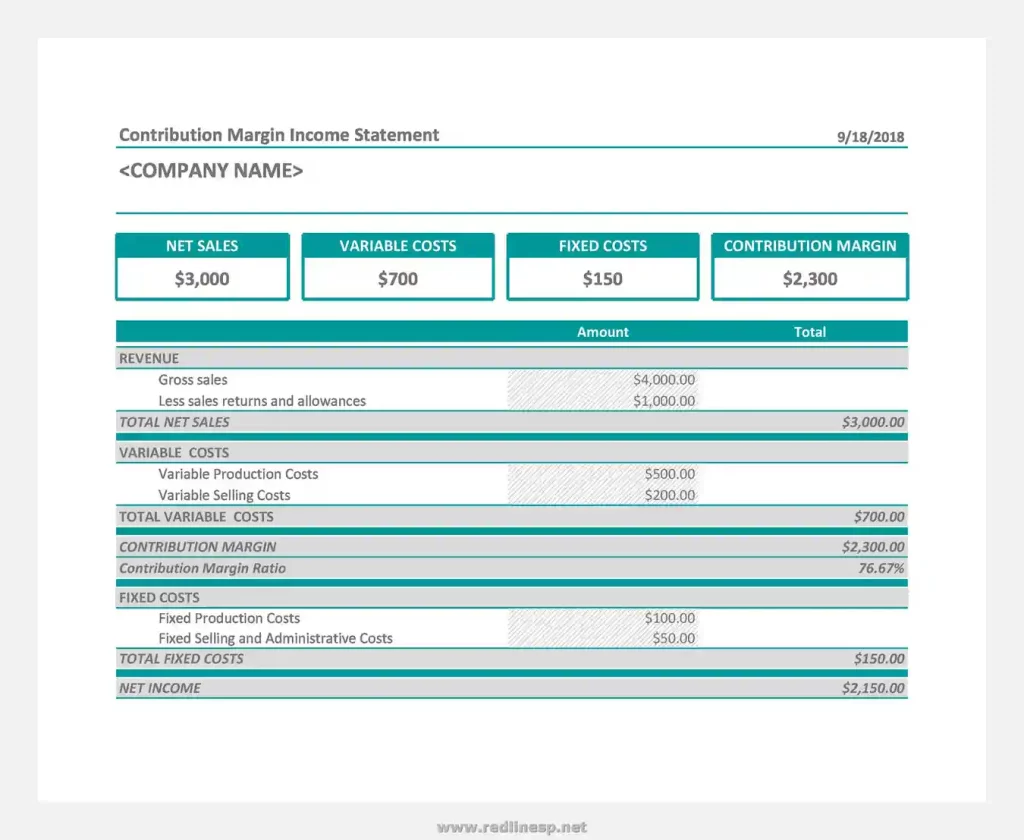

- Contribution Margin Income Statement

- What It Is: This type shows the contribution margin, which is revenue minus variable costs.

- Use: It helps understand how different costs affect profit.

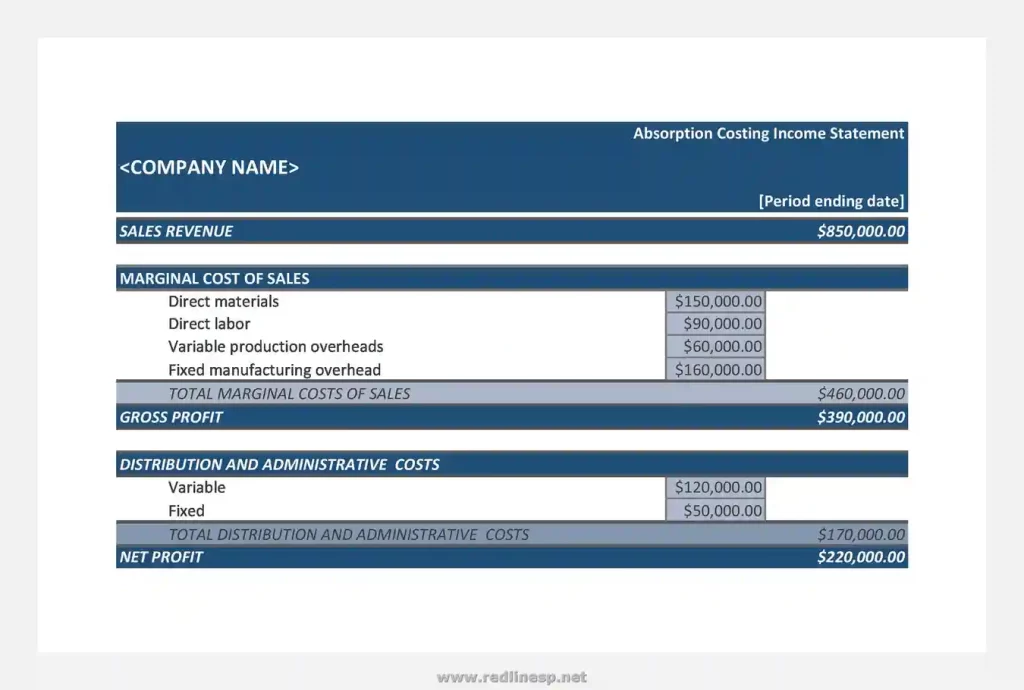

- Absorption Costing Income Statement

- What It Is: This type includes all manufacturing costs, both fixed and variable.

- Use: It is used for financial reporting and inventory valuation.

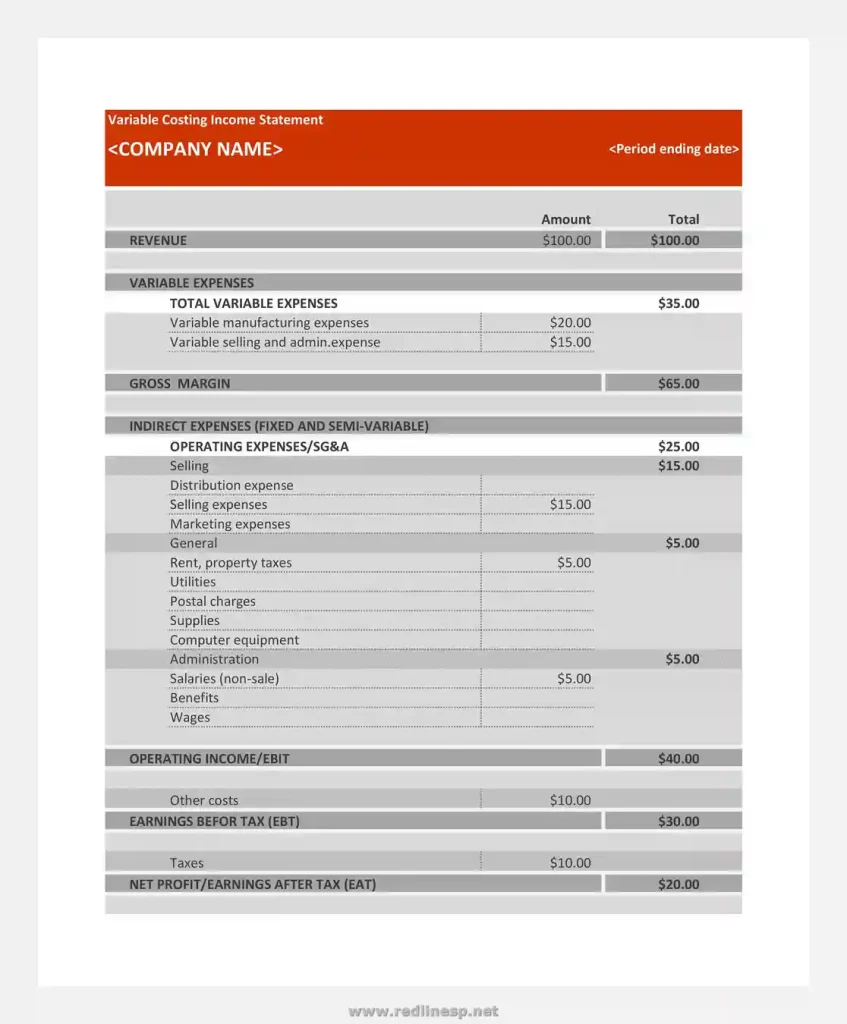

- Variable Costing Income Statement

- What It Is: This type only includes variable manufacturing costs.

- Use: It is used for internal decision-making.

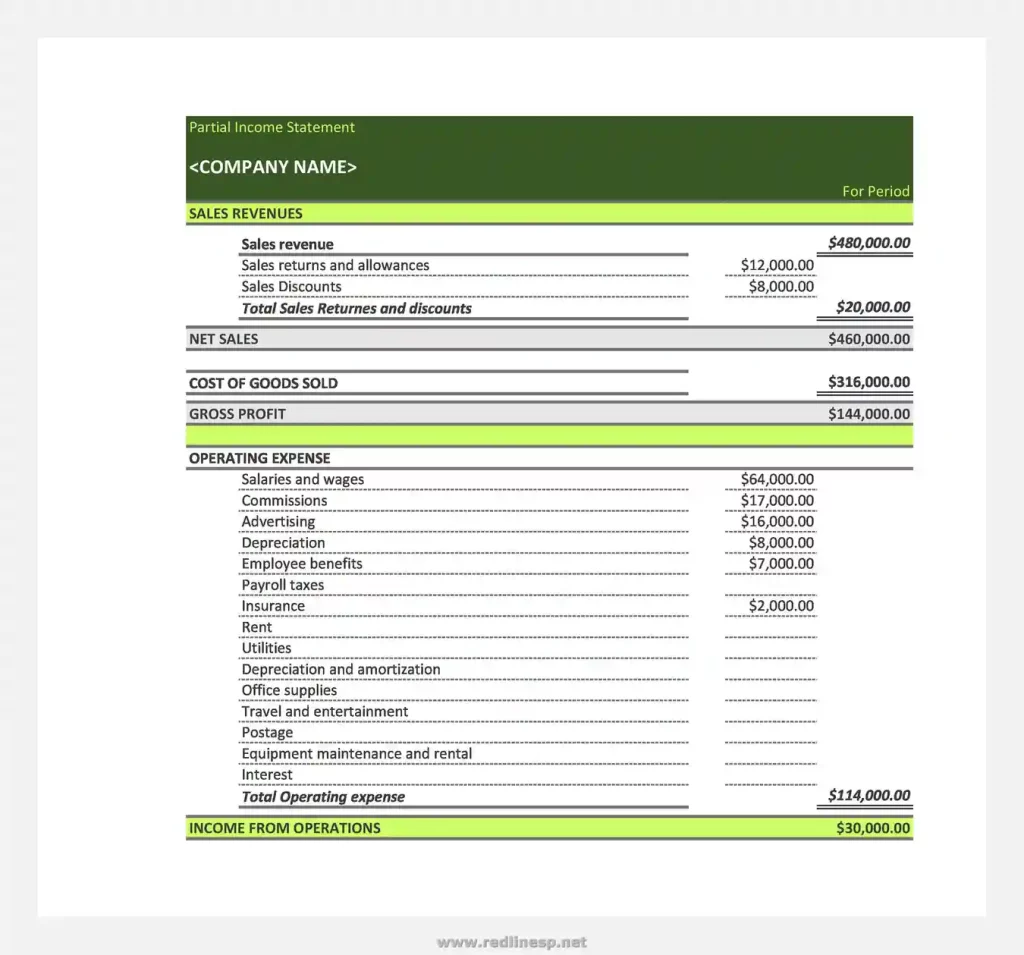

- Partial Income Statement

- What It Is: This type shows only a portion of the total income and expenses.

- Use: It helps analyze specific parts of a business.

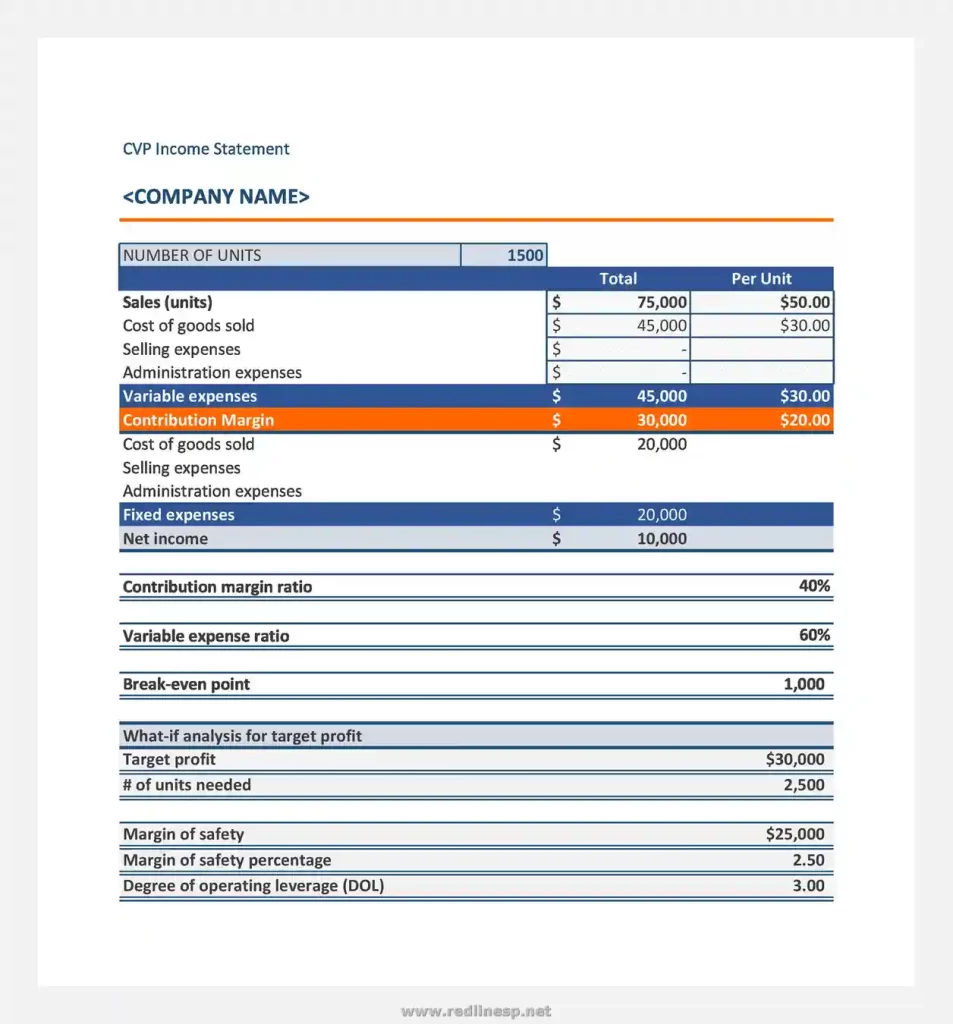

- CVP Income Statement

- What It Is: CVP stands for Cost-Volume-Profit. This type shows how changes in costs and volume affect profit.

- Use: It is helpful for break-even analysis and planning.

- Segmented Income Statement

- What It Is: This type shows income and expenses for different parts of a business.

- Use: It helps understand the performance of different segments.

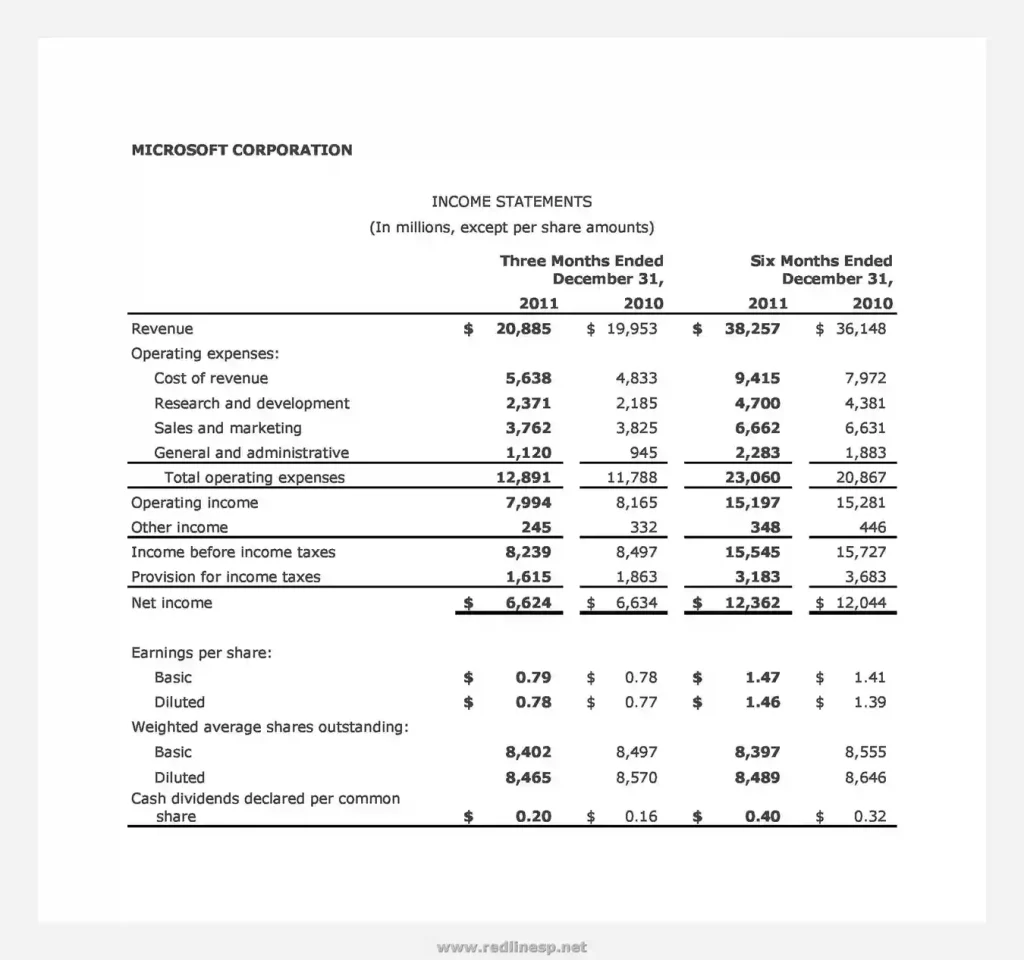

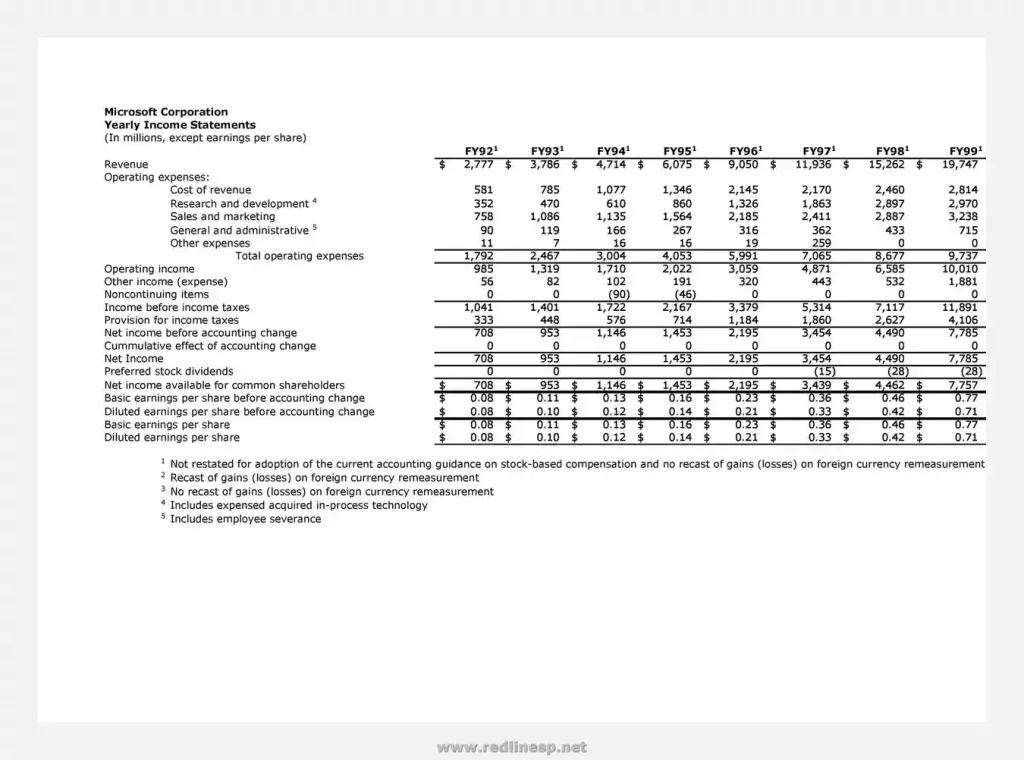

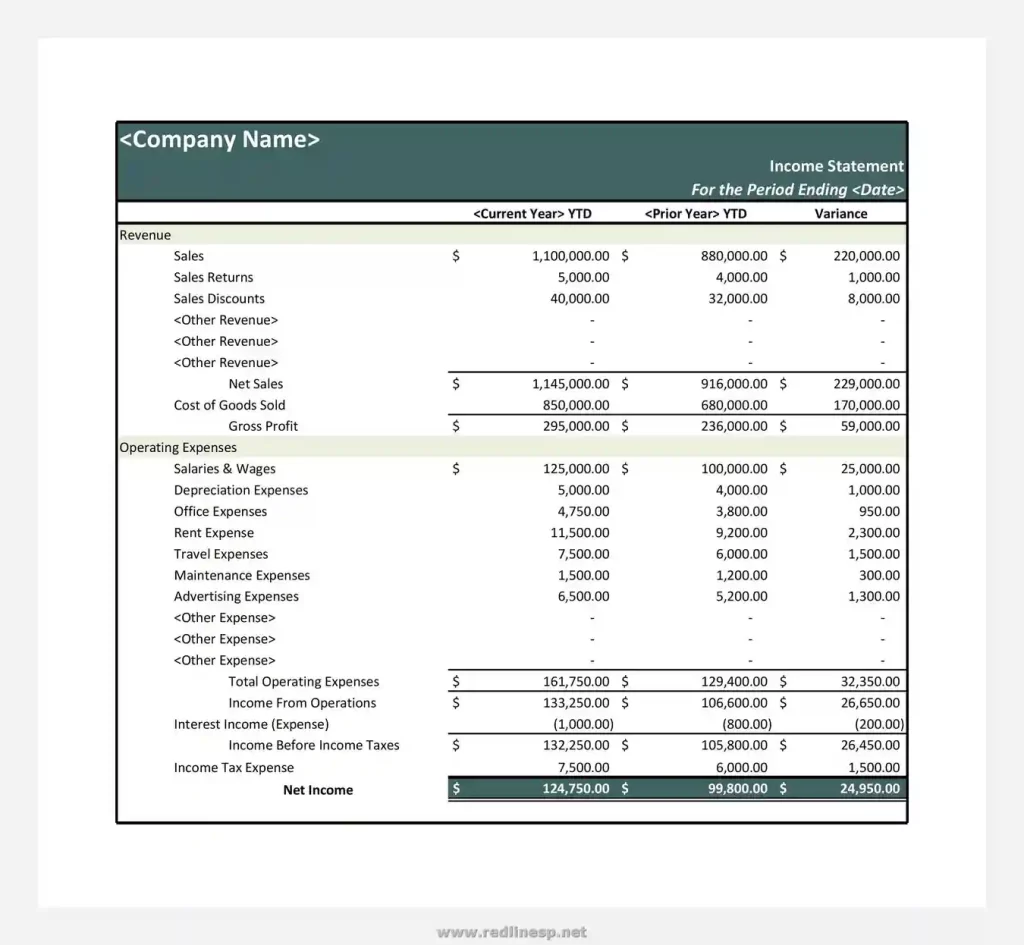

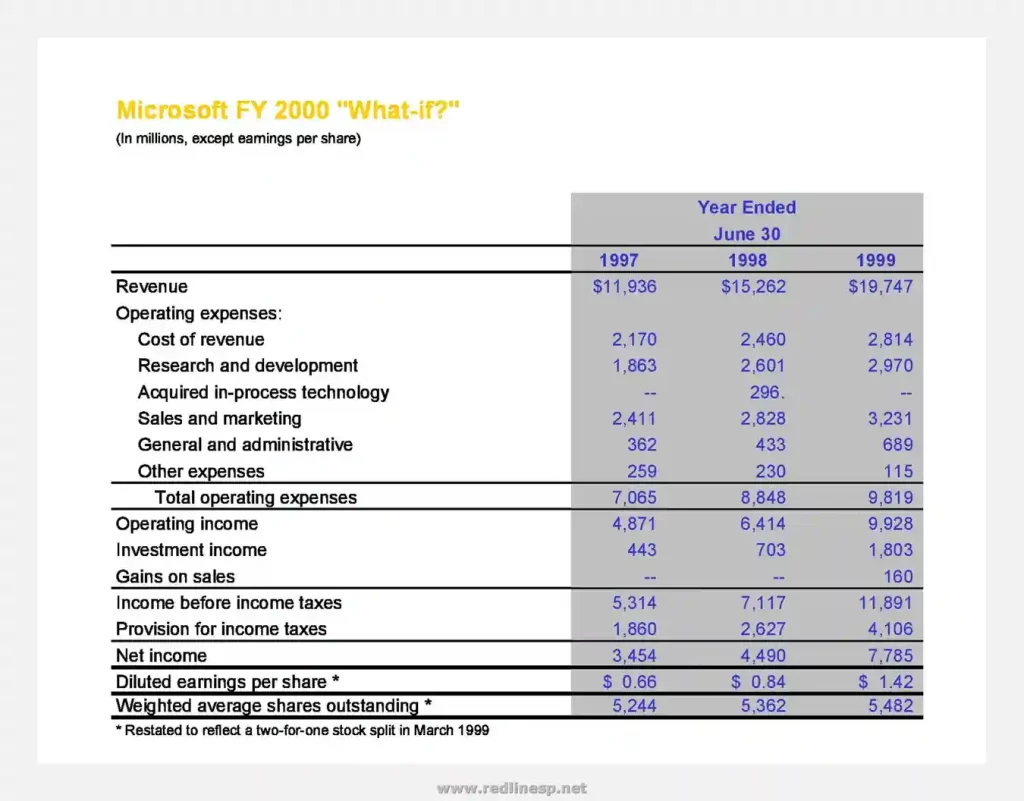

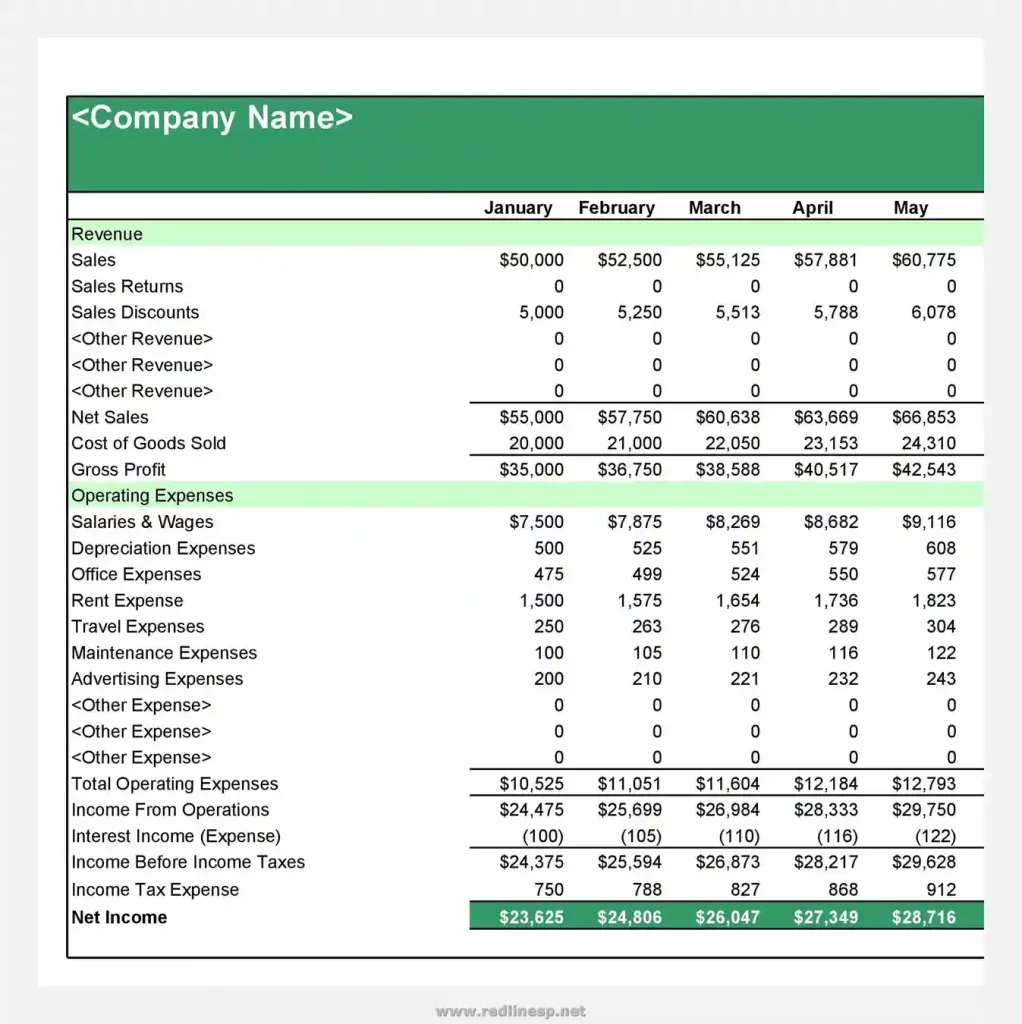

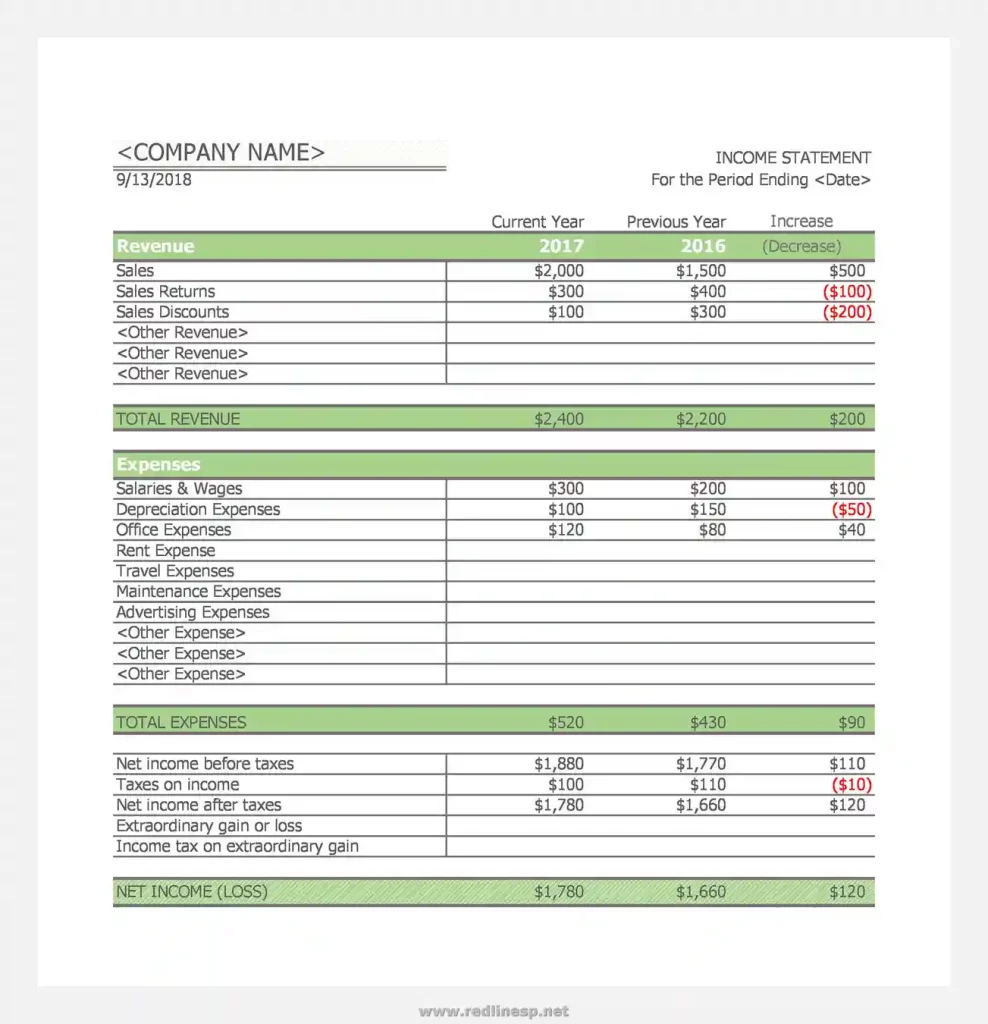

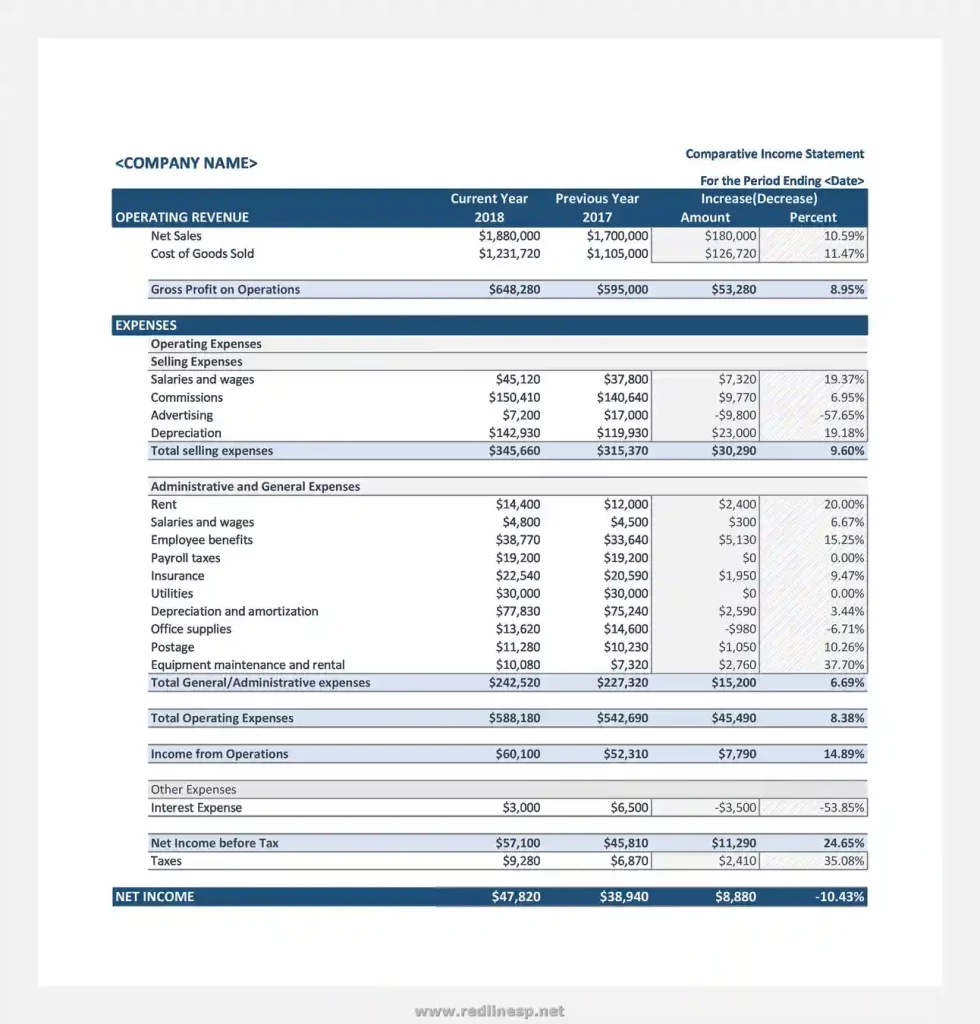

- Comparative Income Statement

- What It Is: This type compares income statements from different periods.

- Use: It helps in analyzing trends over time.

- Projected Income Statement

- What It Is: This type estimates future income based on past data and plans.

- Use: It is used for budgeting and planning.

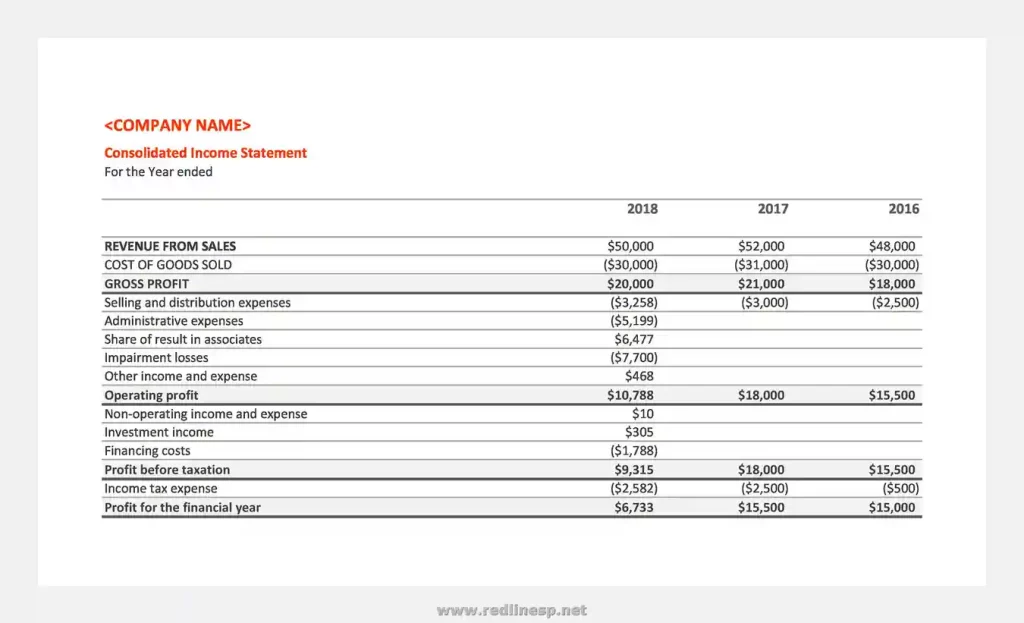

- Consolidated Income Statement

- What It Is: This type combines the income statements of different parts of a business into one.

- Use: It gives a complete picture of the financial health of a whole organization.

Different types of income statements are used for other purposes. Understanding these types can help you choose the right one for your needs.

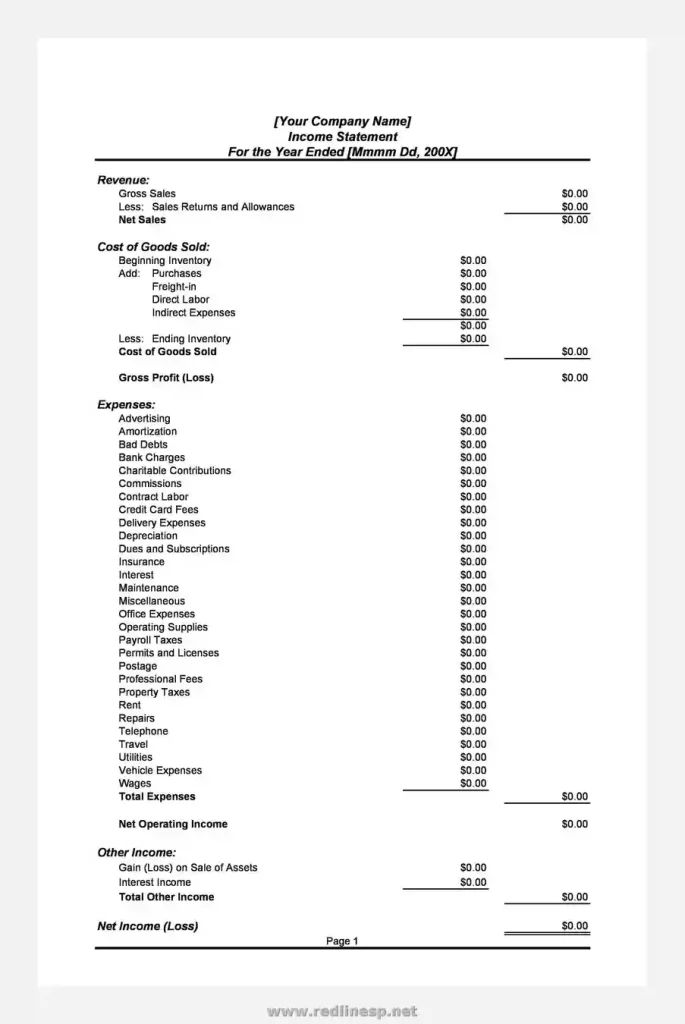

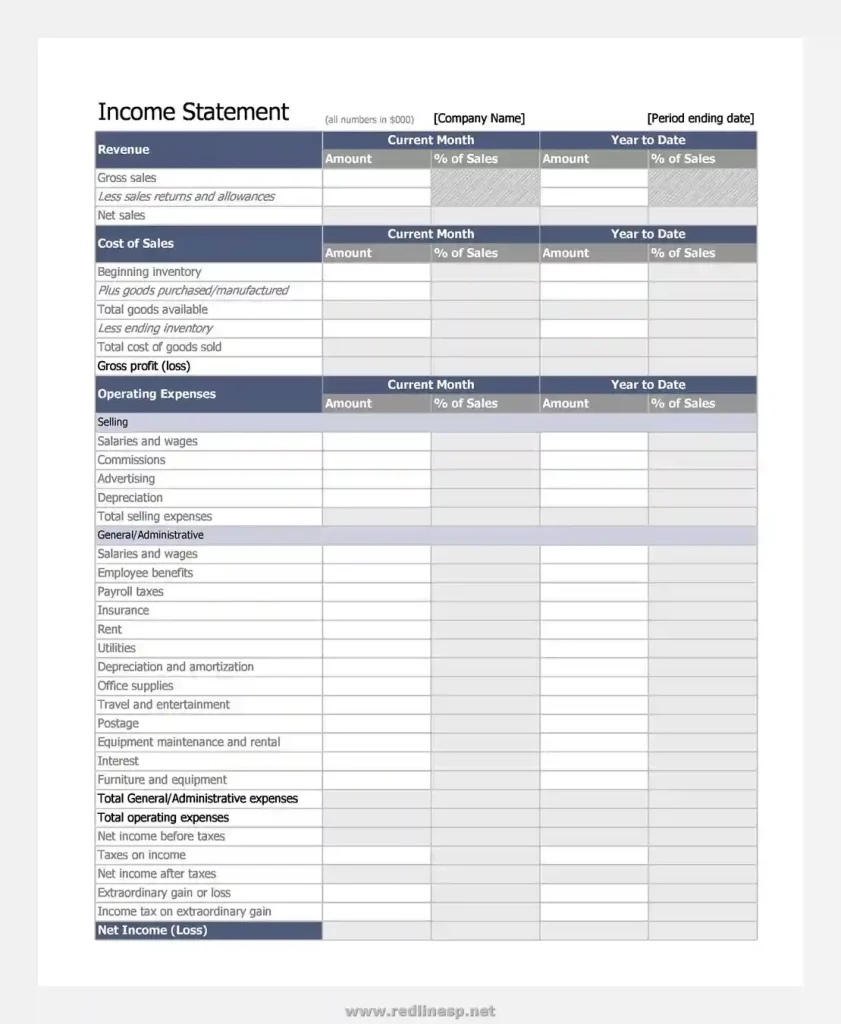

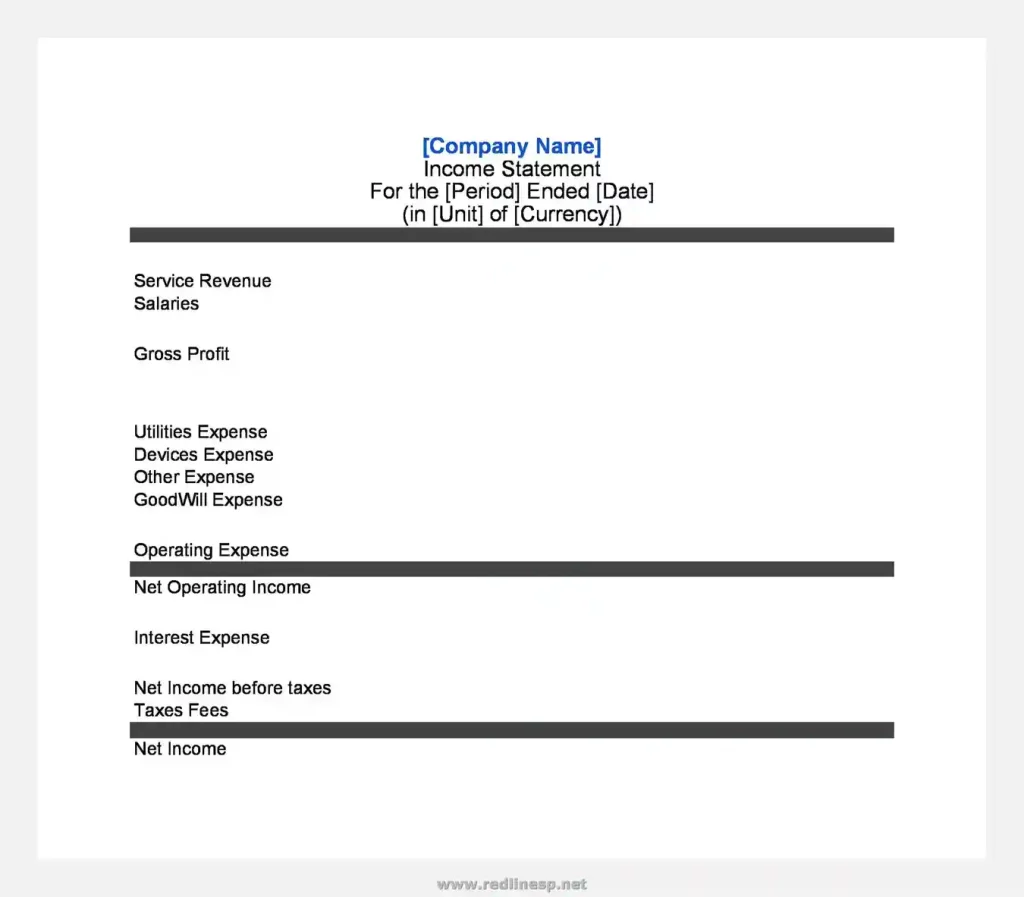

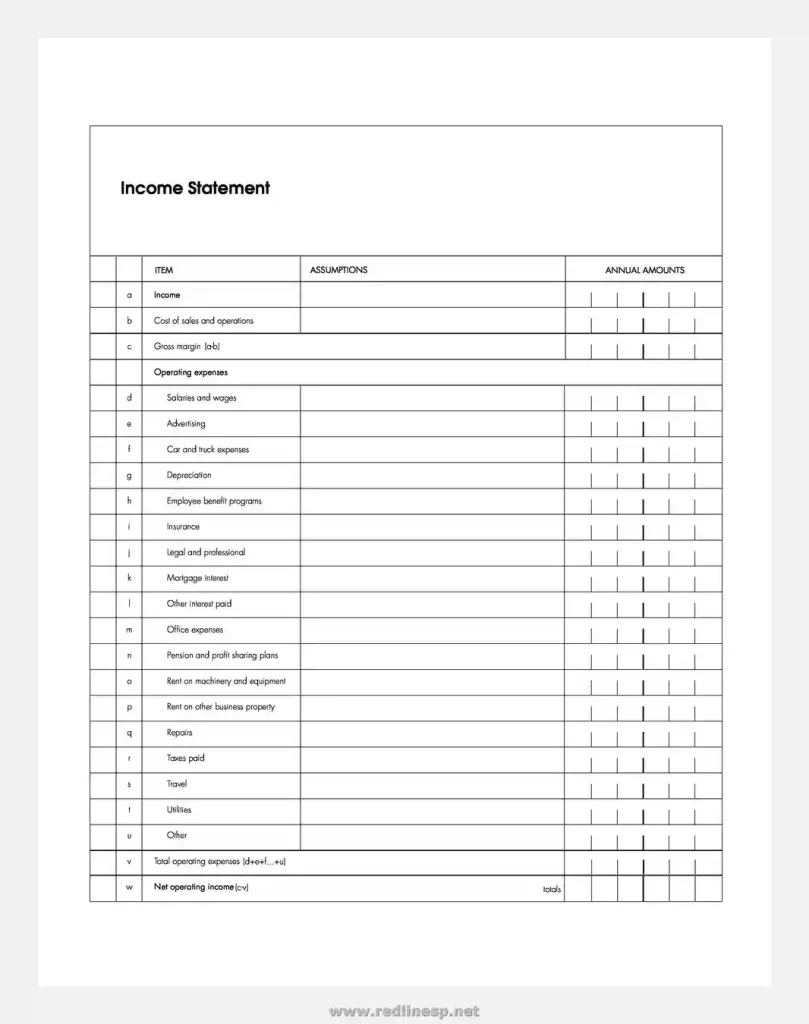

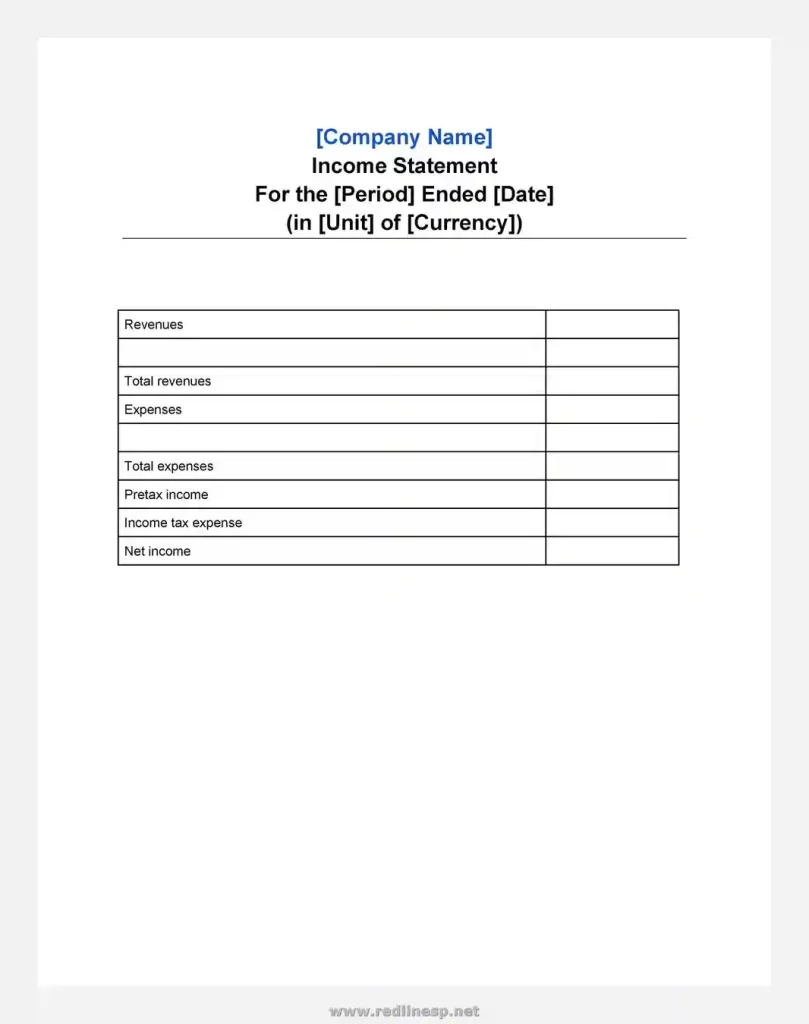

Income Statement Template

Common Mistakes to Avoid

When using an income statement template, it’s easy to make mistakes. Here are some common mistakes and how to avoid them:

Incorrect Data Entry:

- What It Is: This means entering the wrong numbers.

- How to Avoid: Always double-check your entries. Make sure the numbers you write down are correct. Use tools like calculators or software to help.

Ignoring Small Expenses:

- What It Is: This means not recording little costs like coffee or snacks.

- How to Avoid: Write down every expense, no matter how small. Small costs can add up and make a big difference.

Not Updating Regularly:

- What It Is: This means keeping your income statement updated.

- How to Avoid: Update your income statement regularly, like every week or month. Set reminders to make sure you do it.

Mixing Personal and Business Expenses:

- What It Is: This means putting personal costs in your business income statement.

- How to Avoid: Keep your personal and business expenses separate. Use different accounts or statements for each.

Forgetting to Include All Revenue:

- What It Is: This means recording only some of the money you make.

- How to Avoid: Write down every source of income. Include everything, like sales, services, or other earnings.

Overlooking Discounts and Returns:

- What It Is: This means not accounting for money lost due to discounts or product returns.

- How to Avoid: Subtract any discounts or returns from your total revenue. Keep track of these separately.

Avoiding these mistakes will help you create a more accurate and helpful income statement. It will give you a better picture of your finances.

Simple Income Statement Template

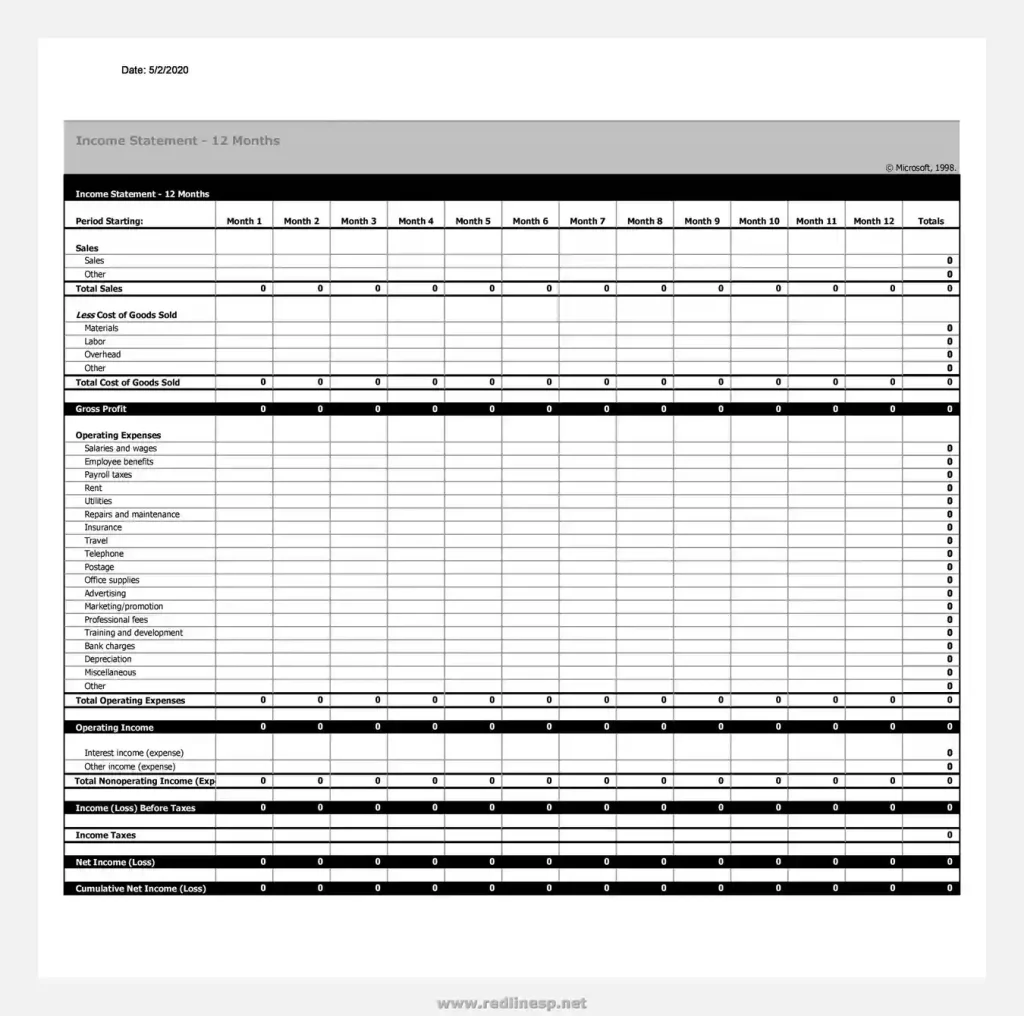

How to Create a Simple Income Statement Template

Here’s a guide:

- List Your Revenue: Write down all money earned from products or services.

- Record Your Expenses: Write down all costs, including rent, utilities, and supplies.

- Calculate Net Income: Subtract total expenses from total revenue to find net income.

Tools like Excel or Google Sheets have built-in templates that make this process easier.

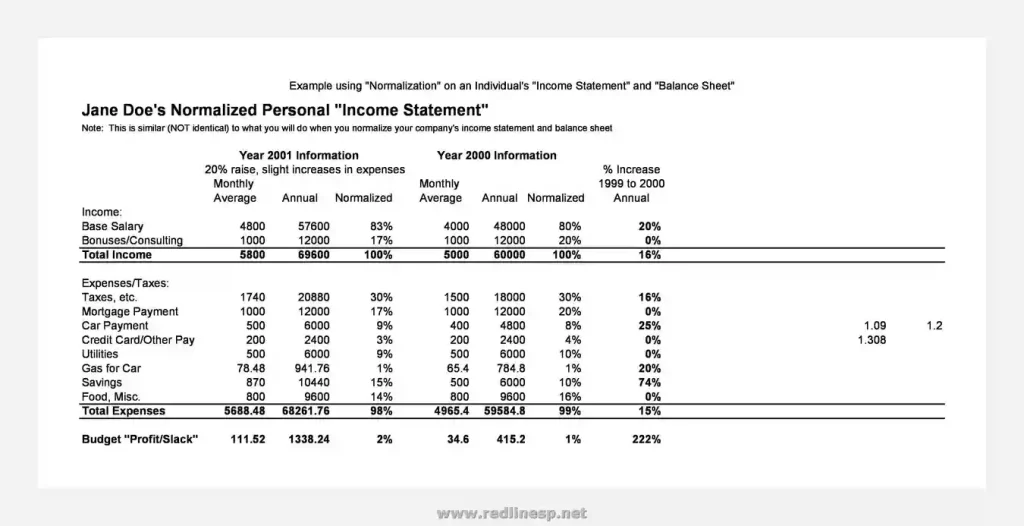

Using an Income Statement for Personal Finances

An income statement isn’t just for businesses. You can use it for personal finances too. Here’s how:

- Track Your Income: Write down all money earned from jobs, gigs, or other sources.

- List Your Expenses: Write down all spending, including rent, utilities, groceries, and entertainment.

- Calculate Your Net Income: Subtract total expenses from total income to see how much money is left each month.

You’ll know if you’re spending too much in one area and need to cut back. This way, you can ensure you have enough money for the things most important to you.

Example Templates

To help you get started, here’s a simple example of what your income statement might look like:

Business Income Statement Example:

- Revenue:

- Sales: $2,000

- Services: $500

- Expenses:

- Rent: $800

- Utilities: $150

- Salaries: $700

- Office Supplies: $100

- Net Income:

- Total Revenue: $2,500

- Total Expenses: $1,750

- Net Income: $750

Personal Income Statement Example:

- Income:

- Job Salary: $3,000

- Side Gig: $200

- Expenses:

- Rent: $1,000

- Utilities: $150

- Groceries: $300

- Entertainment: $100

- Net Income:

- Total Income: $3,200

- Total Expenses: $1,550

- Net Income: $1,650

This tool will help you understand and manage your finances for business or personal use.

Income Statement vs. Balance Sheet

Income Statement:

- An income statement shows your income and expenses over time and tells you whether you made a profit or a loss.

- It includes revenue, expenses, and net income.

- It helps you see how your business is doing. You can see if you are making money or need to cut costs.

Balance Sheet:

- A balance sheet shows your financial position at a specific point in time. It lists what you own (assets) and owe (liabilities).

- It includes assets, liabilities, and equity.

- It helps you understand what you have and what you owe, and it can help you determine whether you are financially healthy.

Key Differences:

- The income statement covers a month or a year period, while the balance sheet is a snapshot of one moment in time.

- The income statement focuses on profitability. The balance sheet focuses on financial health.

The income statement shows how well you are doing over time, and the balance sheet shows what you have at a specific moment.

Updating an Income Statement

Keeping your income statement up to date is very important. It helps you see the latest financial information and make better decisions. Here’s how to keep your income statement current:

- Regular Updates: Many businesses do this every month. For personal finances, update it weekly or monthly.

- Accurate Data: Double-check your entries to avoid mistakes. This includes both your revenue and expenses.

- Include All Transactions: This means recording every sale and expense, no matter how small.

- Use Tools: Use tools like Excel or Google Sheets to help you. These tools can make updating your income statement easier and more accurate. They can also do the math for you, which saves time.

- Review Regularly: Look for trends and see where you can improve. This can help you make better financial decisions.

- Adjust as Needed: Correct mistakes or missing information immediately if you notice mistakes or missing information.

You will know exactly where your money is coming from and where it is going. This can help you plan for the future and ensure you are on the right track.

Example: Imagine you run a small coffee shop. Each month, you update your income statement. You record all the money you make from selling coffee and snacks. You also write down all your expenses, like rent, electricity, and supplies.

By the end of the month, you can see if you made a profit or need to make changes. You may have spent too much on supplies or need to find ways to increase your sales. Keeping your income statement updated helps you see these things.

Income Statement Example Template

Income Statement Template Sample

Finding Free Income Statement Templates

Finding a free income statement template is easy. Many websites offer them for free. Here’s how you can find and use them:

Where to Find Templates

- Microsoft Office: This website has many templates for different needs. Income statement templates are available in Excel format.

- Google Sheets: Google Sheets also offers free templates. You can access them from your Google Drive.

- Accounting Software Websites: Many accounting software companies offer free templates. Websites like QuickBooks, FreshBooks, and Wave have templates you can download.

- Other Online Resources: Many different websites offer free income statement templates. A quick search online will give you many options. Websites like Template.net and Smartsheet have a variety of templates from which to choose.

How to Use the Templates

- Download the Template: First, find a template that fits your needs. Then, download it to your computer or save it to your Google Drive.

- Customize the Template: Once you have the template, you can customize it. Enter your information, like your revenue and expenses. You can also change the layout and design to make it easier.

- Update Regularly: Update your income statement regularly, adding new revenue and expenses as they occur. This will help you monitor your financial health.

Benefits of Using Templates

- Saves Time: Using a template saves you time. You don’t have to create an income statement from scratch. The template does the hard work for you.

- Easy to Use: Templates are designed to be user-friendly. They often include instructions and examples to help you.

- Accurate: Templates help you avoid mistakes. They have built-in formulas that do the math for you. This helps ensure your income statement is correct.

- Professional Look: Templates give your income statement a professional look. This can be important if you need to show it to others, like investors or lenders.

Using a free income statement template can make managing your finances more manageable.

Example: Imagine you run a small bakery. You want to keep track of your sales and costs. You can find a free income statement template on Google Sheets.

You download it and enter your sales and expenses for the month. The template automatically calculates your net income. Now you can see if your bakery is making a profit. This helps you decide whether to change your prices or cut costs.

Role of an Income Statement in Financial Planning

An income statement is a handy tool for financial planning. Here’s how it helps:

- Budgeting:

- How It Helps: An income statement shows how much you earn and spend. This helps you create a budget. You can plan how much money to save and how much to spend.

- Example: If your income statement shows you spend a lot on eating out, you can budget to eat at home more and save money.

- Forecasting:

- How It Helps: An income statement can help you predict future finances. You can see trends in your earnings and expenses.

- Example: If your sales increase every December, you can plan for higher income.

- Monitoring Financial Health:

- How It Helps: An income statement helps you track your financial health. You can see whether you are making a profit or a loss.

- Example: If you see that your expenses are more than your income, you can find ways to cut costs or increase earnings.

- Making Informed Decisions:

- How It Helps: An income statement gives you the information you need to make sound financial choices. You can decide where to invest money or what costs to cut.

- Example: If a particular product is not selling well, you might stop selling it and try something new.

- Setting Financial Goals:

- How It Helps: An income statement can help you set and achieve financial goals. You can track your progress over time.

- Example: If you want to save $1,000, use your income statement to see where to save monthly money.

Using an income statement for financial planning makes managing money easier. It helps you see where your money goes and how to use it better.

Income Statement FAQs

What is the order of the subtotals on a multi-step income statement?

The subtotals on a multi-step income statement should appear in this order:

- Gross Profit

- Operating Income

- Other Revenues and Expenses

- Net Income

Where are selling and administrative expenses found on the multi-step income statement?

Selling and administrative expenses are listed under Operating Expenses as separate items.

What is the advantage of using the multi-step income statement?

The multi-step income statement provides many details. It shows Gross Profit and separates Operating Income from Non-Operating Income, making it easier to understand.

How do you calculate COGS (Cost of Goods Sold) for an income statement?

To calculate COGS, use this formula: Opening Inventory+Purchases−Closing Inventory=COGS\text{Opening Inventory} + \text{Purchases} – \text{Closing Inventory} = \text{COGS}Opening Inventory+Purchases−Closing Inventory=COGS

Where is depreciation expense found on the income statement?

Depreciation expense is listed under a single-step income statement, and operating costs are listed on a multi-step income statement.

Where is interest expense listed on the income statement?

Interest expense is listed under Expenses on a single-step income statement and Non-Operating or Other on a multi-step income statement.

Where is bad debt expense reported on the income statement?

Bad debt expense is listed under a single-step income statement, and operating costs are listed on a multi-step income statement.

What period does an income statement cover?

An income statement can cover any period, like a month, a quarter, or a year. Most companies prepare income statements every three months or every year.

Why is the income statement important?

The income statement shows how well a company is doing financially over time. It helps with planning and decision-making and gives a clear picture of a company’s financial health.

A simple income statement template is essential for anyone looking to manage their finances better.

It provides a clear picture of your financial situation, helps you plan for the future, and ensures that your business or personal finances are on the right track. Start using an income statement template today and take control of your finances.